For the 24 hours to 23:00 GMT, GBP fell 0.38% against the USD and closed at 1.5740, after credit ratings agency, Moody’s put the UK on negative outlook.

In the Asian session, at GMT0400, the pair is trading at 1.5715, with the GBP trading 0.16% lower from yesterday’s close.

This morning, the Royal Institution of Chartered Surveyors (RICS) reported that, on a seasonally adjusted basis, the House Price Balance Index in the UK stood at a reading of -16.0 in January, unchanged from December’s reading.

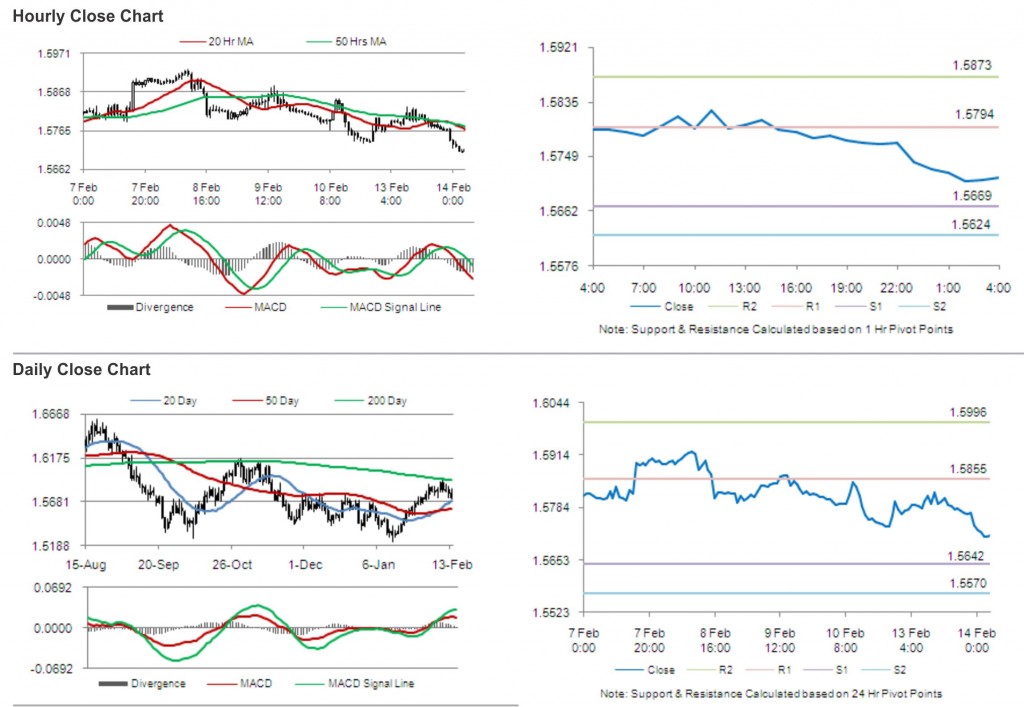

The pair is expected to find support at 1.5669, and a fall through could take it to the next support level of 1.5624. The pair is expected to find its first resistance at 1.5794, and a rise through could take it to the next resistance level of 1.5873.

With a series of the UK economic releases today, including retail prices and consumer prices, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.