For the 24 hours to 23:00 GMT, GBP fell 0.73% against the USD and closed at 1.5523, after minutes of the Bank of England Monetary Policy Committee rate-setting meeting indicated increased support for additional quantitative easing in the future.

In the UK, members of the Monetary Policy Committee (MPC) of the Bank of England (BoE) unanimously voted to maintain the central bank’s asset purchase programme at £275.0 billion and to leave the benchmark interest rate unchanged at 0.50%. The Minutes indicated that some of the members believed that further bond purchases would be required, while other members indicated that risks around hitting the inflation target “were more balanced.”

Meanwhile, the British Bankers’ Association (BBA) reported that mortgage approvals for house purchase climbed to 35,295 in October, from an upwardly revised 33,502 in September.

In the Asian session, at GMT0400, the pair is trading at 1.5555, with the GBP trading 0.21% higher from yesterday’s close.

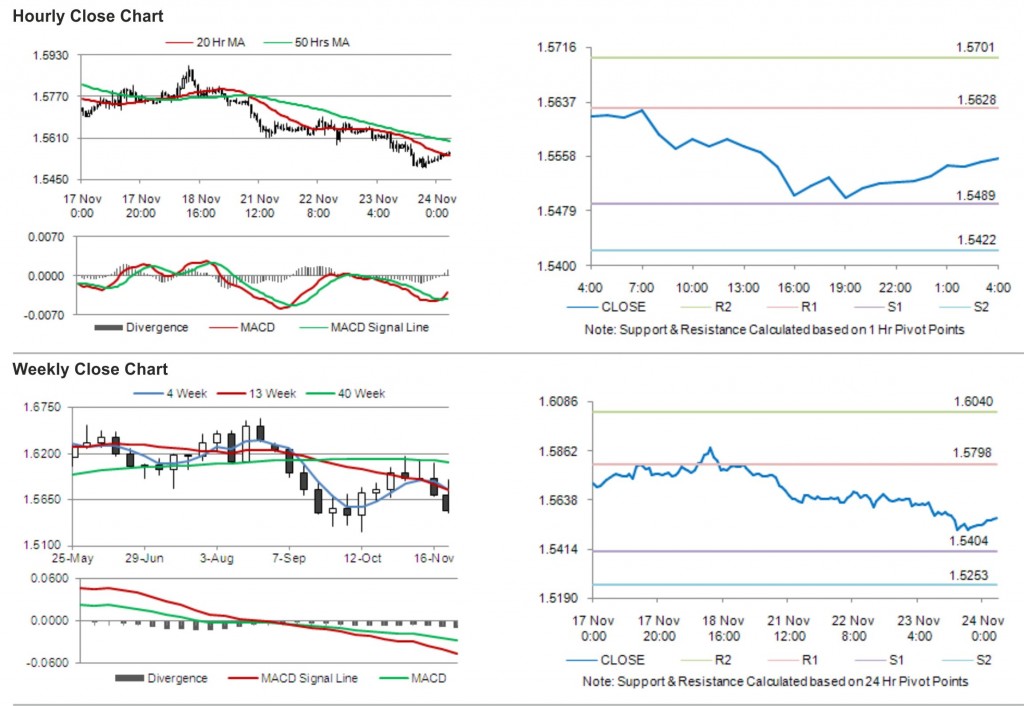

The pair is expected to find support at 1.5489, and a fall through could take it to the next support level of 1.5422. The pair is expected to find its first resistance at 1.5628, and a rise through could take it to the next resistance level of 1.5701.

With a series of UK economic releases today, including Gross Domestic Product (GDP) and Index of Services, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.