For the 24 hours to 23:00 GMT, GBP fell marginally against the USD and closed at 1.5816.

Lloyds Banking Group’s Halifax division reported that the House Price Index in the UK climbed 0.6% (MoM) in January, following a 1.0% drop in December.

In the Asian session, at GMT0400, the pair is trading at 1.5805, with the GBP trading 0.07% lower from yesterday’s close, after the British Retail Consortium reported that on a like-for-like basis, retail sales in the UK declined 0.3% (YoY) in January, the second-worst January performance since 1995.

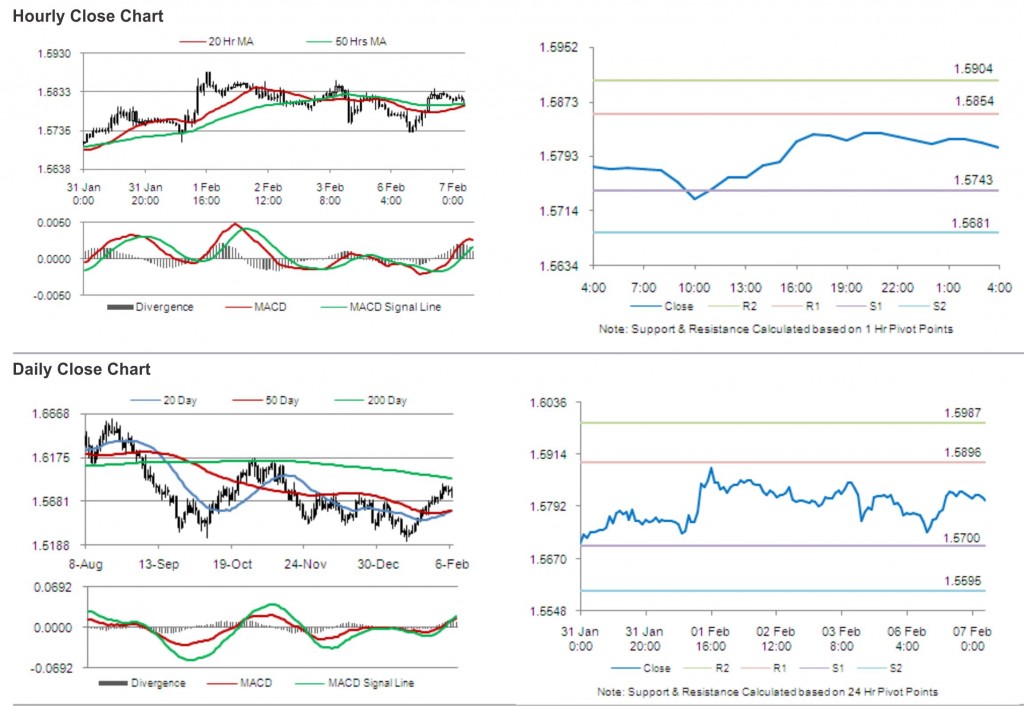

The pair is expected to find support at 1.5743, and a fall through could take it to the next support level of 1.5681. The pair is expected to find its first resistance at 1.5854, and a rise through could take it to the next resistance level of 1.5904.

The UK economic calendar being almost empty today, the pair is expected to ride on other market cues.

The currency pair is converging its 20 Hr and 50 Hr moving averages.