For the 24 hours to 23:00 GMT, GBP rose 0.60% against the USD and closed at 1.6023.

The National Institute for Economic and Social Research (NIESR) has indicated that there is a 50% chance that the British economy would slip back into recession. The agency further added that the recent poor performance has been driven by weak domestic demand, rather than developments in the Euro area, and that it does not expect the UK economy to return to pre-recession peak until the end of 2013.

In economic news, the services Purchasing Managers’ Index (PMI) in the UK declined to 51.3 in October, compared to 52.9 in September.

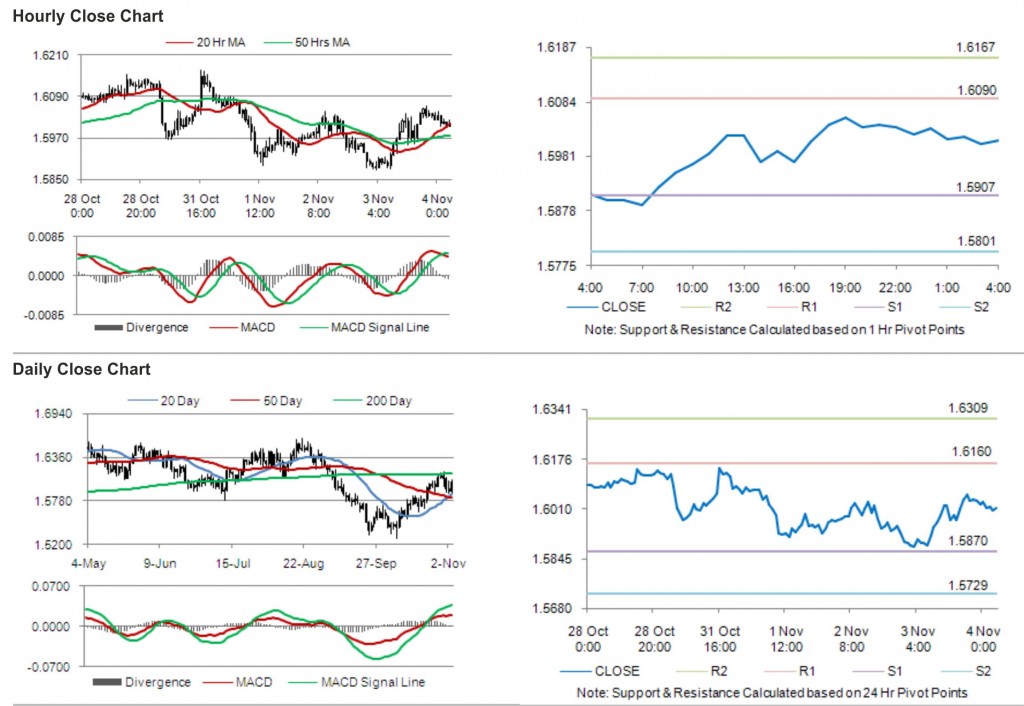

In the Asian session, at GMT0400, the pair is trading at 1.6012, with the GBP trading 0.07% lower from yesterday’s close.

The pair is expected to find support at 1.5907, and a fall through could take it to the next support level of 1.5801. The pair is expected to find its first resistance at 1.6090, and a rise through could take it to the next resistance level of 1.6167.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.