For the 24 hours to 23:00 GMT, the GBP rose marginally against the USD and closed at 1.7029.

Yesterday, a BoE policymaker, David Miles, in his written newspaper comment, highlighted his willingness to vote for an interest rate hike before his departure from the central bank in May 2015. Meanwhile, in a BBC television interview, UK Finance Minister, George Osborne applauded BoE Governor, Mark Carney’s decision to communicate the central bank’s further path future path of interest rates. Last week, Mark Carney hinted that interest rates in the economy would rise as economic recovery in the nation strengthens. Separately, the BoE, in its quarterly credit conditions survey, revealed that mortgage demand in the economy had increased significantly in the current quarter and also highlighted lenders’ expectation for it to rise further in the coming months.

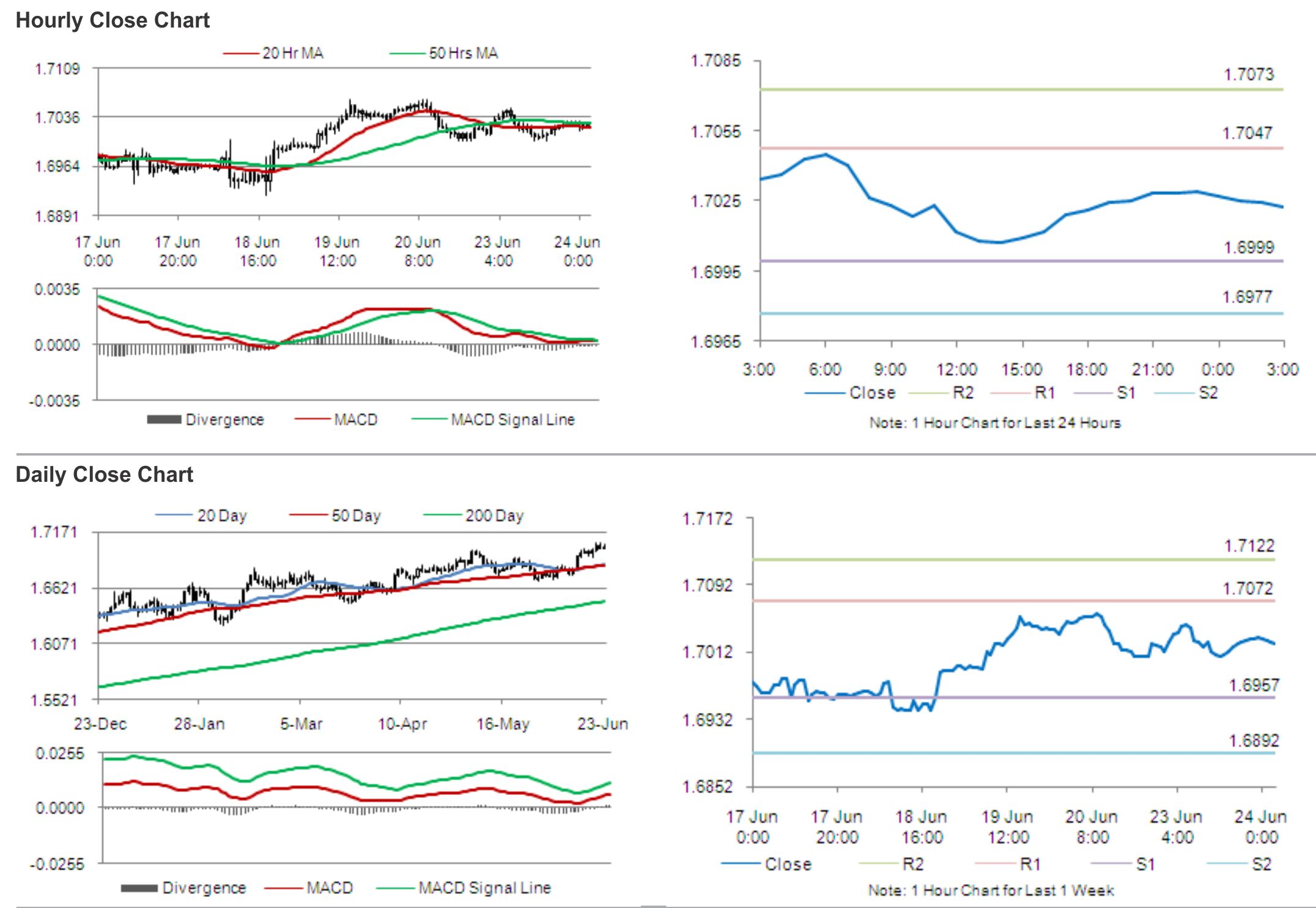

In the Asian session, at GMT0300, the pair is trading at 1.7022, with the GBP trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.6999, and a fall through could take it to the next support level of 1.6977. The pair is expected to find its first resistance at 1.7047, and a rise through could take it to the next resistance level of 1.7073.

Later today, traders keenly await UK’s inflation report hearing and the BBA mortgage approvals data, for further guidance in the British Pound.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.