For the 24 hours to 23:00 GMT, the GBP declined 0.58% against the USD and closed at 1.2669, as investors were still spooked by the outcome of last week’s snap election in the UK that resulted in a hung parliament.

Losses in the Pound deepened, after two of the most influential ratings agencies, Moody’s and S&P, warned that the inconclusive outcome of Britain’s snap election will probably delay Brexit negotiations and may also result in credit rating downgrade.

Meanwhile, the British Prime Minister, Theresa May, was seeking a deal with a small Northern Ireland’s Democratic Unionist Party (DUP) in order to overcome the problems of a hung parliament.

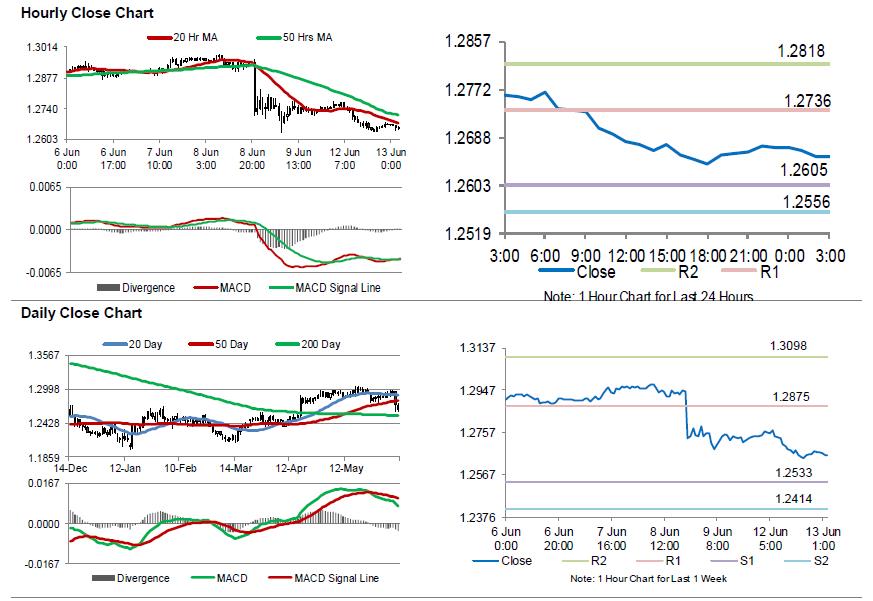

In the Asian session, at GMT0300, the pair is trading at 1.2653, with the GBP trading 0.13% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2605, and a fall through could take it to the next support level of 1.2556. The pair is expected to find its first resistance at 1.2736, and a rise through could take it to the next resistance level of 1.2818.

Ahead in the day, market participants will focus on UK’s crucial inflation figures for May.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.