For the 24 hours to 23:00 GMT, GBP rose 0.67% against the USD and closed at 1.6125, as Japan’s escalating nuclear crisis boosted demand for safe haven currencies, weighing heavily on the greenback.

In the UK, nationwide consumer confidence index fell to 38.0 in February from 48.0 in January. Additionally, spending index declined to 52.0 points in February from 70.0 in January.

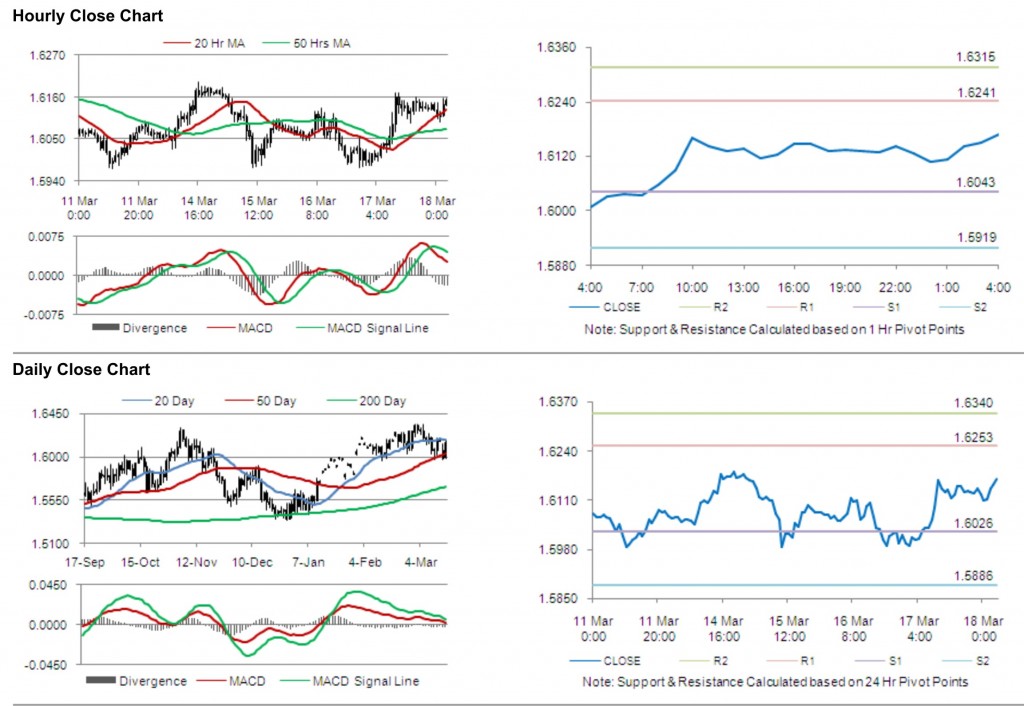

The pair opened the Asian session at 1.6125, and is trading at 1.6167 at 4.00GMT. The pair is trading 0.26% higher from the New York session close.

The pair has its first short term resistance at 1.6241, followed by the next resistance at 1.6315. The first support is at 1.6043, with the subsequent support at 1.5919.

The pair is expected to trade on the cues from the release of data on public sector net borrowing and mortgage approvals in the UK.

The currency pair is showing convergence with its 20 Hr and is trading just above its 50 Hr moving average.