On Friday, GBP rose 0.24% against the USD and closed at 1.6973, amid lingering optimism on a sooner-than-expected interest rate hike in the UK economy.

On the economic front, the CB leading economic index in the UK economy rose at a faster pace of 0.5% in April while construction output in Britain rose 4.9% year-on-year in April.

In the Asian session, at GMT0300, the pair is trading at 1.6982, with the GBP trading slightly higher from Friday’s close.

Earlier today, the BoE Deputy Governor, Charlie Bean opined that an interest rate hike in the Britain economy would “be an indication that the nation is on the road back to normality.” Separately, the BoE, in its quarterly research paper, pointed out towards a weakness in the UK labour productivity since the onset of the 2007-08 financial crisis and attributed it to low investment and inefficient allocation of resources in the nation. In other economic news, Rightmove’s monthly house price index in the UK rose 0.1% in June, much slower compared to a 3.6% rise in the previous month.

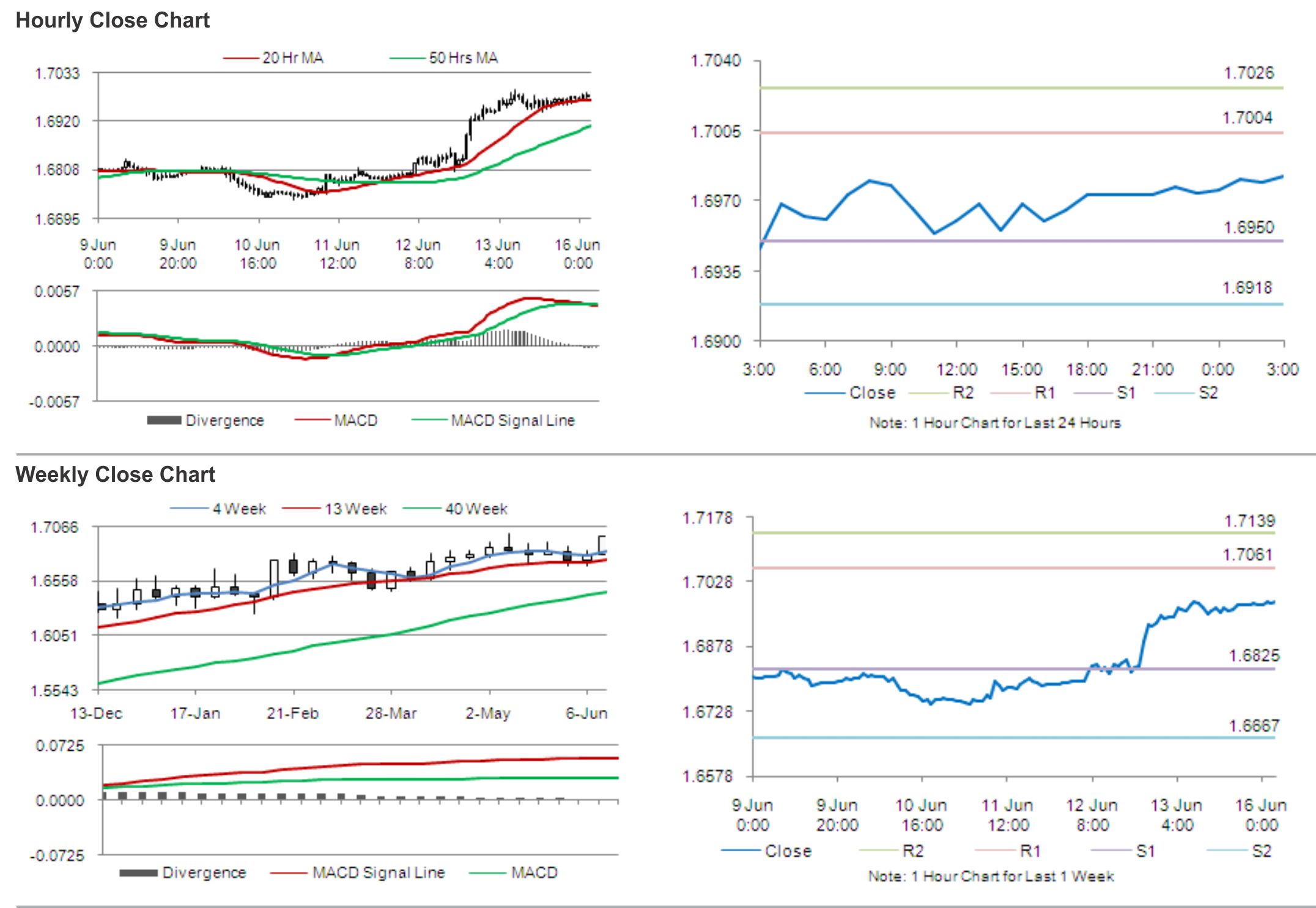

The pair is expected to find support at 1.6950, and a fall through could take it to the next support level of 1.6918. The pair is expected to find its first resistance at 1.7004, and a rise through could take it to the next resistance level of 1.7026.

With no major economic releases in the UK economy later today, traders are expected to shift their focus to tomorrow’s consumer, producer and retail prices data from the UK.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.