For the 24 hours to 23:00 GMT, the GBP fell 0.40% against the USD and closed at 1.6046, after the minutes of the BoE’s latest policy meeting revealed that majority of the policymakers voted to keep the interest rates unchanged at 0.5%. However, two of its policymakers Martin Weale and Ian McCafferty continued their stance for an interest rate hike for the third time in a row. Meanwhile, the policymakers voted unanimously on maintaining the asset purchase facility at £375 billion.

In the Asian session, at GMT0300, the pair is trading at 1.6046, with the GBP trading flat from yesterday’s close.

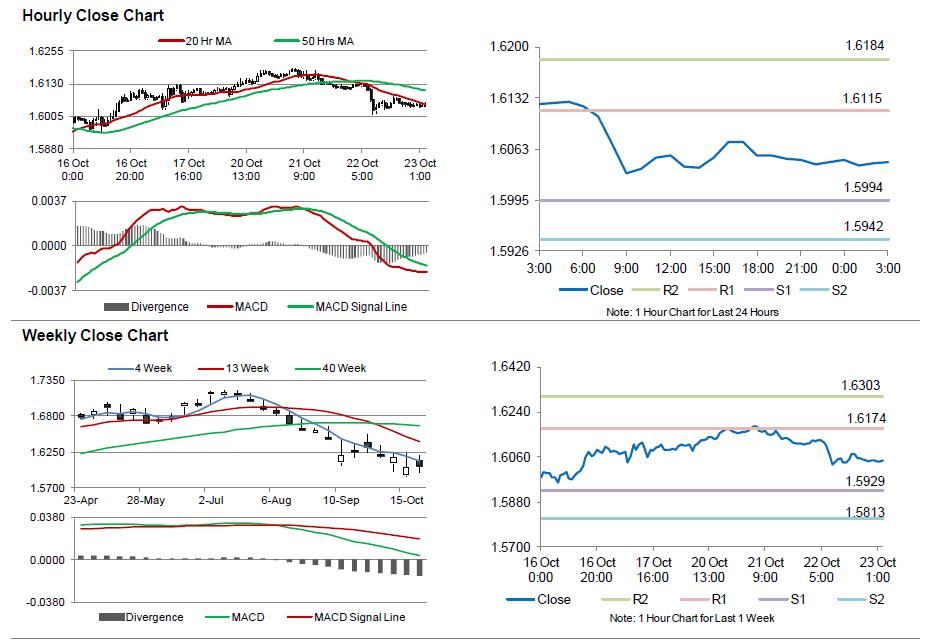

The pair is expected to find support at 1.5994, and a fall through could take it to the next support level of 1.5942. The pair is expected to find its first resistance at 1.6115, and a rise through could take it to the next resistance level of 1.6184.

Going forward, market participants look forward to the UK’s retail sales data as well the BoE’s MPC member Ben Broadbent’s speech, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.