For the 24 hours to 23:00 GMT, the GBP rose 0.29% against the USD and closed at 1.7039.

In the UK, a BoE policymaker, Ian McCafferty, indicated that an interest rate hike in the economy would “depend on how the economy performs over the summer and autumn.” Additionally, he opined that “the economy has grown a little faster” than what markets had expected “at the beginning of the year” while highlighting the fact that unemployment in the nation was significantly higher than its medium-term natural level and that GDP was now approaching its 2008-level.

In other economic news, retail sales in the UK dropped 0.5% (MoM) in May, for first time since January, while the CBI index on industrial order expectations improved more than market expectations to a 6-month high reading of 11.0 in April.

In the Asian session, at GMT0300, the pair is trading at 1.7047, with the GBP trading marginally higher from yesterday’s close.

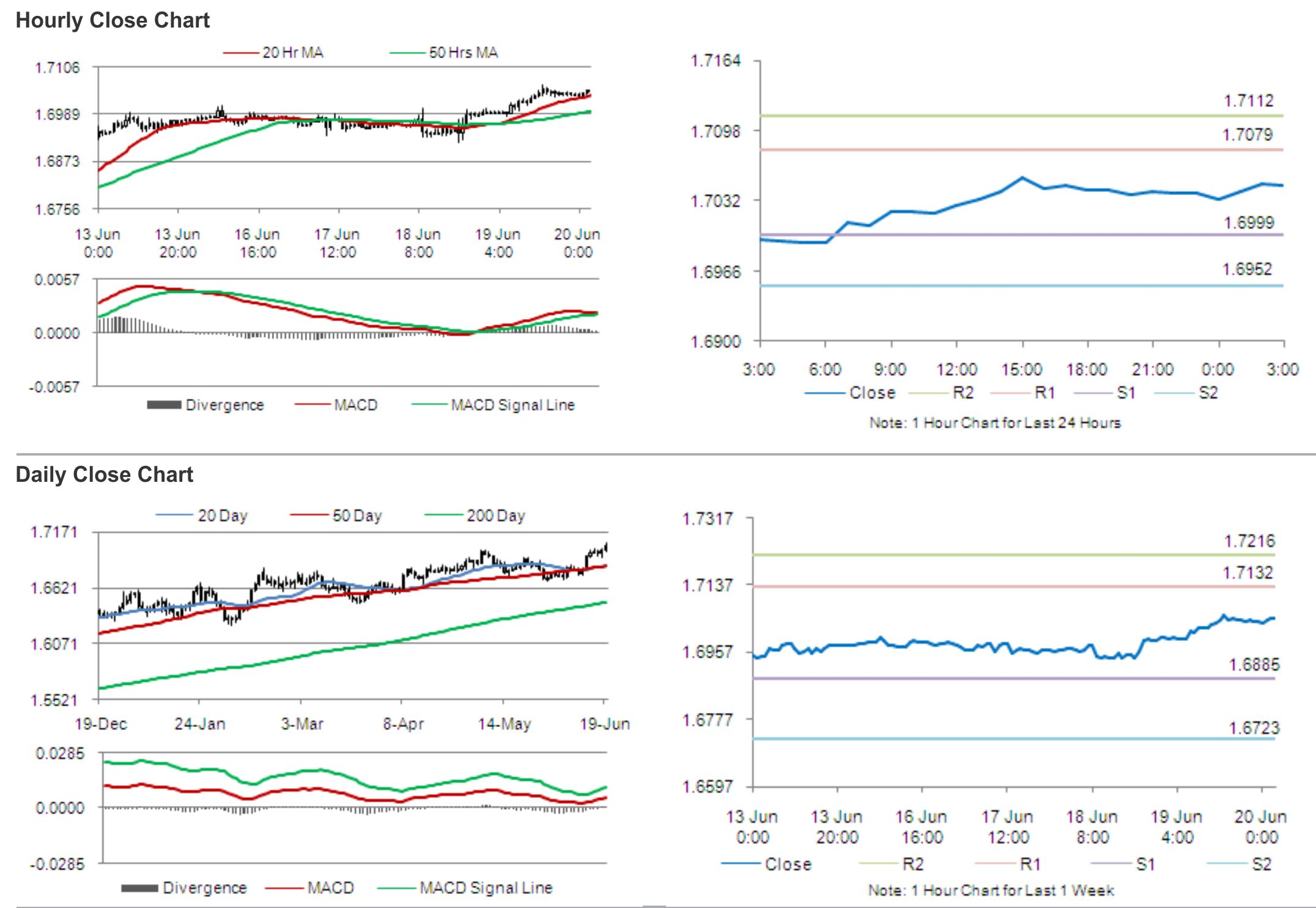

The pair is expected to find support at 1.6999, and a fall through could take it to the next support level of 1.6952. The pair is expected to find its first resistance at 1.7079, and a rise through could take it to the next resistance level of 1.7112.

Later today, the National Statistics is scheduled to publish a report on public sector net borrowings in May, which is widely expected to amount to £12 billion.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.