For the 24 hours to 23:00 GMT, the GBP fell 0.20% against the USD and closed at 1.5609.

Yesterday, the BoE Chief, Mark Carney, in a speech, gave strong signals about the timing of an interest rate hike in the UK, after he mentioned that the central bank could rise its borrowing costs by the end of this year, citing improvement in the nation’s economic recovery.

In the Asian session, at GMT0300, the pair is trading at 1.5634, with the GBP trading 0.16% higher from yesterday’s close.

Going ahead, investors would keenly await for the release of BoE minutes of the latest policy meeting as well its MPC’s decisions on interest rates, to be released next week.

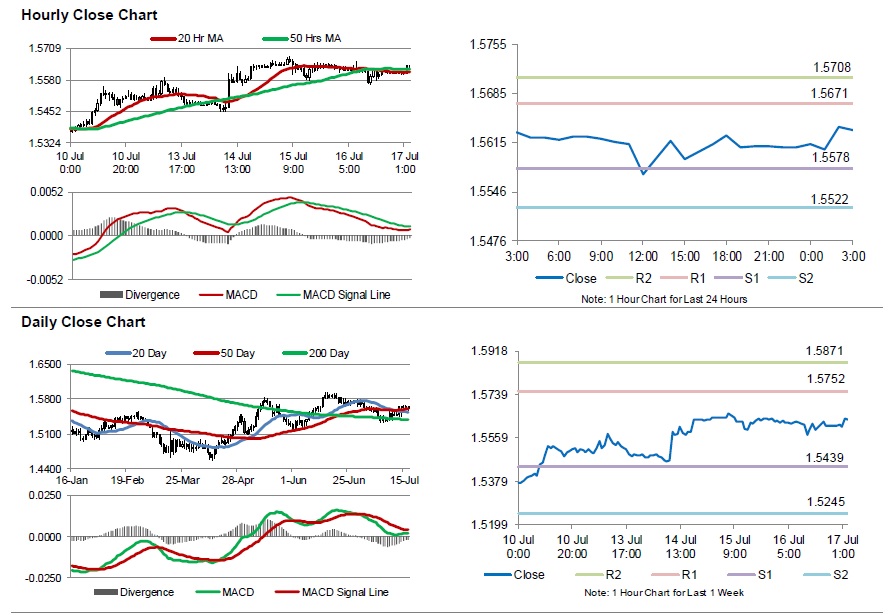

The pair is expected to find support at 1.5578, and a fall through could take it to the next support level of 1.5522. The pair is expected to find its first resistance at 1.5671, and a rise through could take it to the next resistance level of 1.5708.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.