For the 24 hours to 23:00 GMT, GBP rose 0.13% against the USD and closed at 1.6322.

In the UK economic news, the industrial production unexpectedly fell 1.2% (M-o-M) in February, while the monthly manufacturing output remained flat in February. Additionally, Halifax reported the house price index fell 2.9% (Y-o-Y) in March, the biggest annual decline since October 2009. Moreover, the National Institute of Economic and Social Research (NIESR) reported that the GDP rose 0.7% in three months ended in March, following a 0.1% increase in the three months ended in February. Meanwhile, the Society of Motor Manufacturers and Traders (SMMT) reported that new car registration in the UK declined 7.9% (Y-o-Y) to 366,101 units.

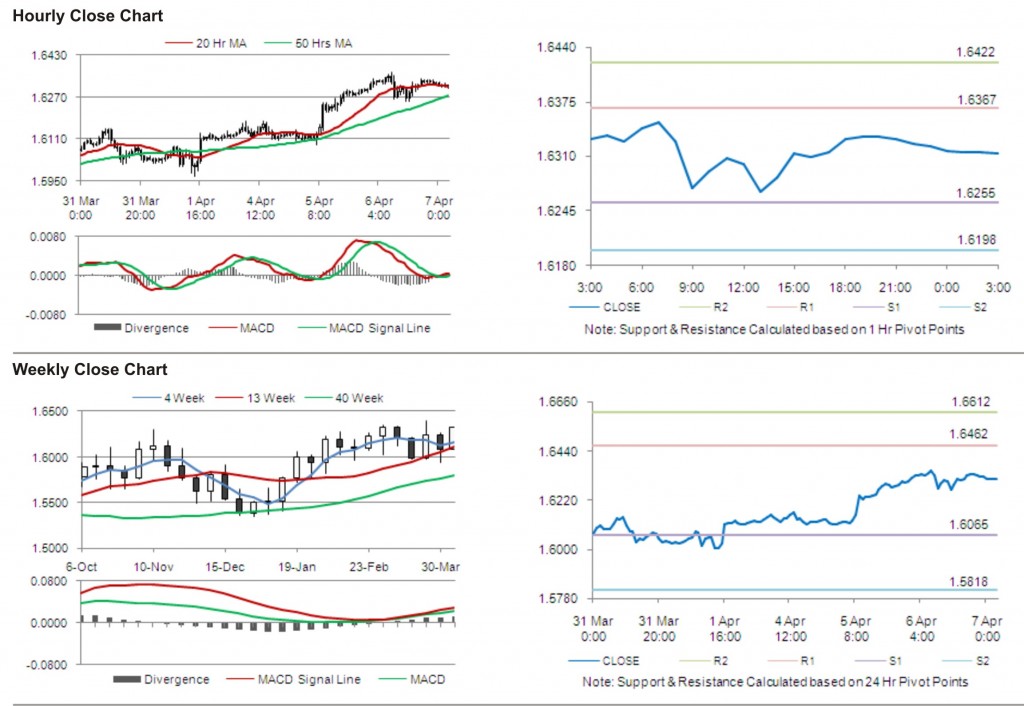

The pair opened the Asian session at 1.6322, and is trading at 1.6313 at 3.00GMT. The pair is trading 0.06% lower from the New York session close.

The pair has its first short term resistance at 1.6367, followed by the next resistance at 1.6422. The first support is at 1.6255, with the subsequent support at 1.6198.

Trading trends in the pair today are expected to be determined by Bank of England Rate Decision due to be released in the day ahead.

The currency pair is showing convergence with 20 Hr moving average and is trading just above its 50 Hr moving average.