For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.2180.

Yesterday, the Bank of England (BoE) Governor, Mark Carney, in a testimony at House of Lords, defended the monetary policy pursued by the central bank in recent years and stated that the BoE’s efforts had a positive impact on Britain’s economy that is “without parallel”. He also stated that monetary policy has been overburdened and added that there were limits to the central bank’s ability to ignore the effects of depreciating pound on inflation.

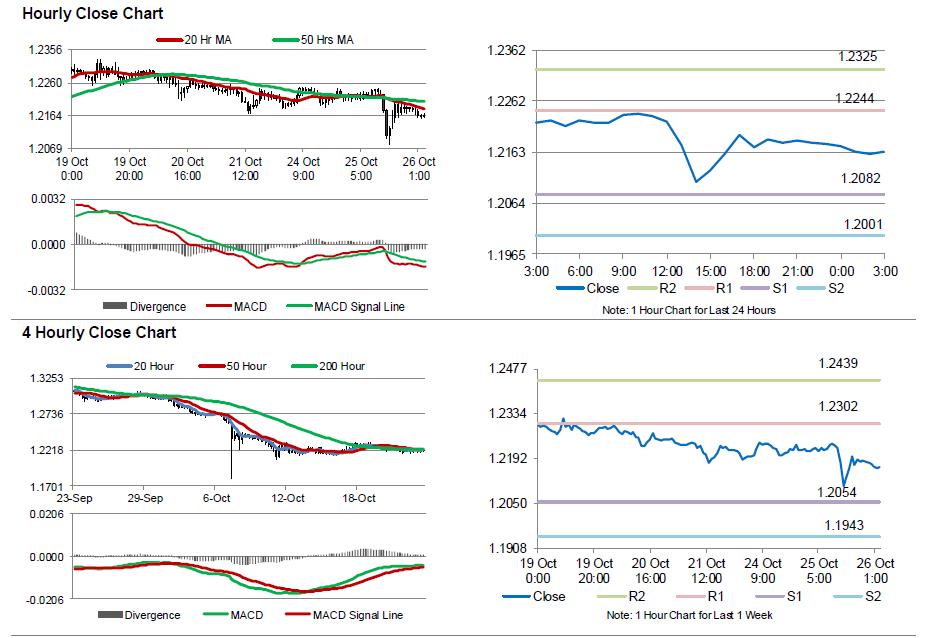

In the Asian session, at GMT0300, the pair is trading at 1.2164, with the GBP trading 0.13% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2082, and a fall through could take it to the next support level of 1.2001. The pair is expected to find its first resistance at 1.2244, and a rise through could take it to the next resistance level of 1.2325.

Going ahead, market participants would await the release of UK’s BBA mortgage approvals for September, due to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.