For the 24 hours to 23:00 GMT, the GBP declined 0.43% against the USD and closed at 1.2447, after a report showed UK’s inflation unexpectedly slowed in October.

Data indicated that UK’s consumer price index increased by 0.1% MoM in October, falling short of market expectations for a rise of 0.3% and following a gain of 0.2% in the previous month. Moreover, the annualised inflation climbed less-than-expected by 0.9% in October, against market expectations for a rise of 1.1% and following a rise of 1.0% in the prior month.

Meanwhile, the Bank of England Governor, Mark Carney, in a testimony to lawmakers, cautioned Britons not to get fooled by last month’s drop in inflation as it is set to accelerate in the coming months, following a slump in the pound.

In the Asian session, at GMT0400, the pair is trading at 1.2471, with the GBP trading 0.19% higher against the USD from yesterday’s close.

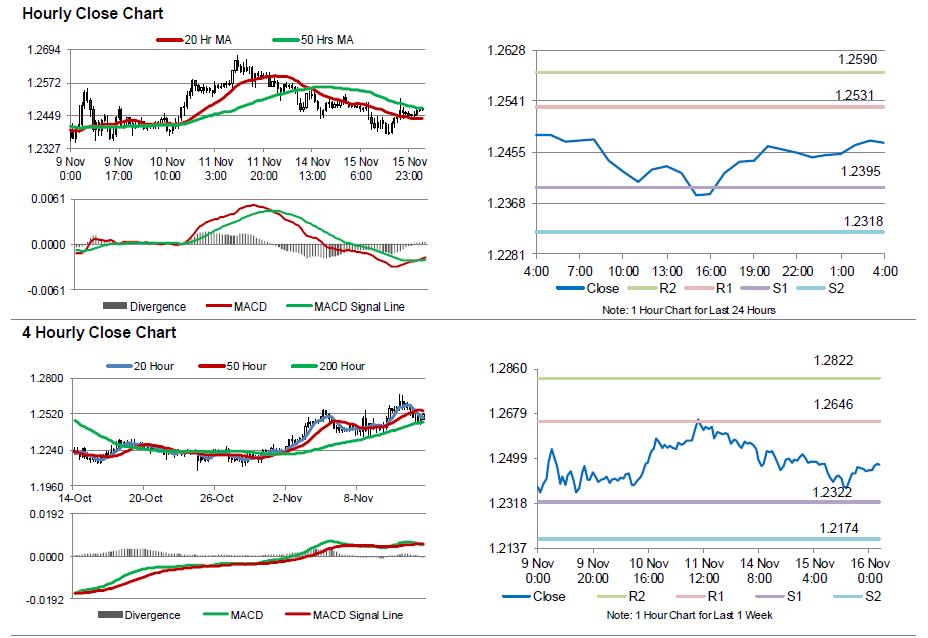

The pair is expected to find support at 1.2395, and a fall through could take it to the next support level of 1.2318. The pair is expected to find its first resistance at 1.2531, and a rise through could take it to the next resistance level of 1.259.

Moving ahead, UK’s ILO unemployment rate for the three months to September, scheduled to release in a few hours, would be on investor’s radar.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.