For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.2202.

On the macro front, UK’s seasonally adjusted Halifax house price index rose 0.1% MoM in February, undershooting market expectations for an advance of 0.4% and following a revised drop of 1.1% in the prior month.

Separately, the OECD predicted the UK economy to expand by 1.6% this year, sharply up from its prior prediction of 1.2% in November, due to a less severe impact from Brexit than it anticipated. However, it still expects Brexit to impose a drag on GDP growth in 2017 and 2018.

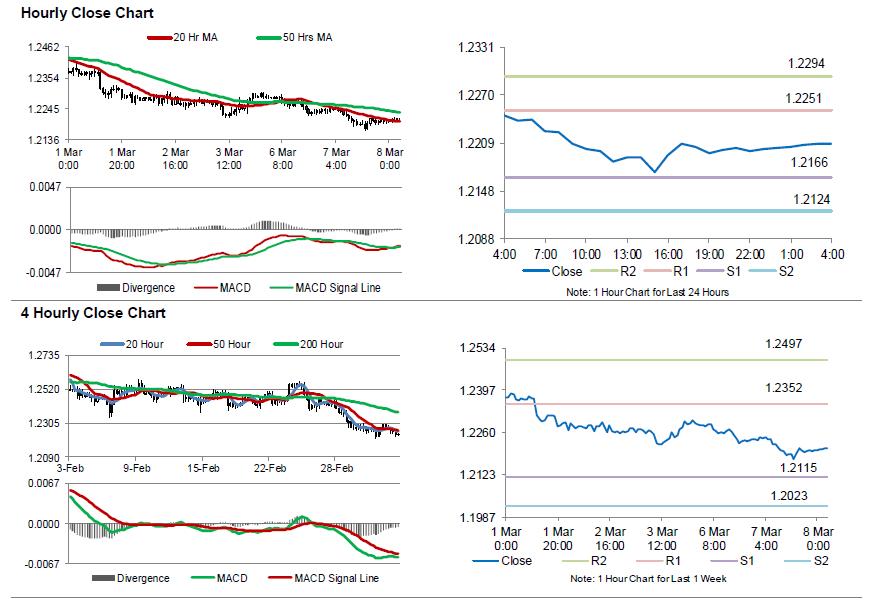

In the Asian session, at GMT0400, the pair is trading at 1.2208, with the GBP trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2166, and a fall through could take it to the next support level of 1.2124. The pair is expected to find its first resistance at 1.2251, and a rise through could take it to the next resistance level of 1.2294.

Moving ahead, investors will eye UK’s spring budget, due to be announced later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.