For the 24 hours to 23:00 GMT, the GBP fell 0.58% against the USD and closed at 1.5511, after the BoE’s minutes for its latest meeting revealed that only one MPC member was in favour of an interest rate hike. The central bank projected the inflation to remain at around zero for the next two months, and indicated that it would gradually rise to its target of 2% at the end of the two-year period, if interest rates are hiked in line with the market’s anticipations. However, losses in the sterling were kept in check after BoE Governor Mark Carney said that although the rate hike timing could not be predicted, the time for it was indeed inching closer.

Leading think-tank, NIESR, reported that that the UK’s estimated GDP rose 0.70% MoM in the May-July 2015 period, after registering a similar rise in the previous period of three months.

In other economic news, industrial production as well as Halifax house price index in the UK unexpectedly dropped in June and July, respectively. On the other hand, Britain’s manufacturing production increased more than expected in June.

In the Asian session, at GMT0300, the pair is trading at 1.5510, with the GBP trading marginally lower from yesterday’s close.

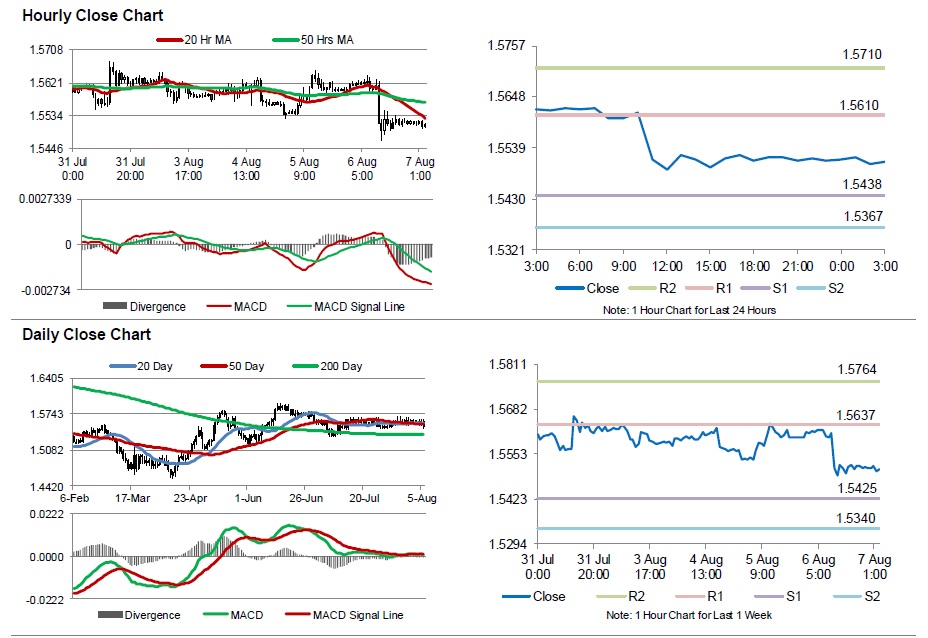

The pair is expected to find support at 1.5438, and a fall through could take it to the next support level of 1.5367. The pair is expected to find its first resistance at 1.5610, and a rise through could take it to the next resistance level of 1.5710.

Trading trends in the pair today are expected to be determined by UK’s trade balance data for June, scheduled to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.