For the 24 hours to 23:00 GMT, GBP fell 0.42% against the USD and closed at 1.6665, as concerns over the Ukraine crisis and upbeat economic data from the US fuelled safe-haven greenback demand.

However earlier during the day, the British Pound firmed after the release of inspiring economic data from the UK. The manufacturing PMI in the UK unexpectedly edged up to a reading of 56.9 in February, from a figure of 56.6 recorded in the preceding month. Additionally, the BoE reported that mortgage approvals in the nation rose more-than-expected to a level of 76,947 in January, the highest level since 2007 and compared to a reading of 72,798 registered in the previous month. Separately, the central bank also reported that consumer credit and net lending to individuals in the UK came in below market expectations for January.

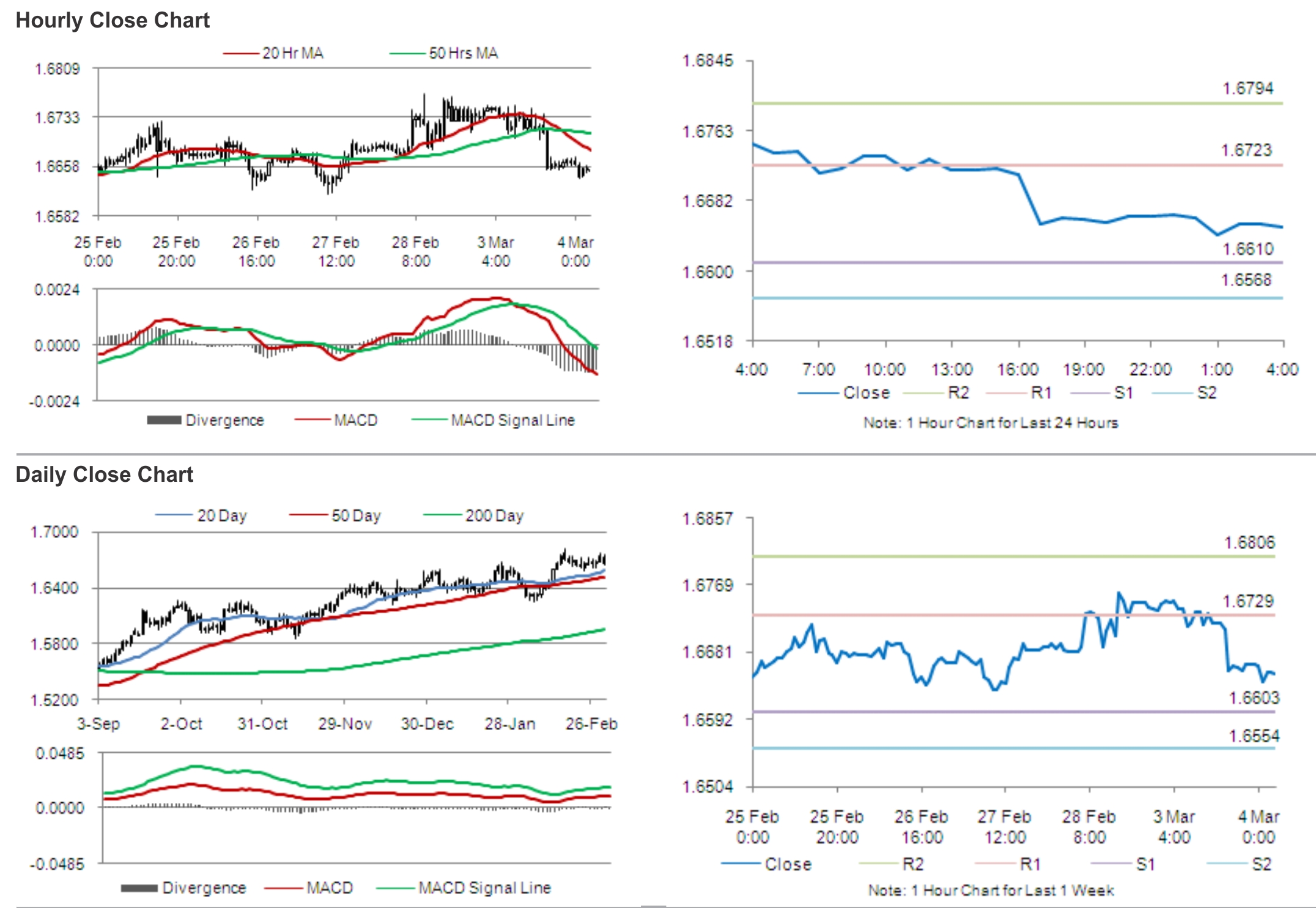

In the Asian session, at GMT0400, the pair is trading at 1.6651, with the GBP trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.6610, and a fall through could take it to the next support level of 1.6568. The pair is expected to find its first resistance at 1.6723, and a rise through could take it to the next resistance level of 1.6794.

Market participants would eye the release of the UK’s construction PMI data, due later today, for further cues in the British Pound.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.