For the 24 hours to 23:00 GMT, GBP fell 0.37% against the USD, on Friday, and closed at 1.5966, amid speculation that the Bank of England would keep interest rates at a record low to counter the stumbling economic growth.

The Bank of England Governor Sir Mervyn King, on Friday stated that the Euro zone debt is a “mess” that poses the “most serious and immediate” risk to the UK banking system. He also stated that the UK banks must provide more information about what holdings of sovereign debt they have and how exposed they are to troubled nations’ banking sectors.

The pair opened the Asian session at 1.5959, and is trading at 1.5926 at 3.00GMT. The pair is trading 0.25% lower from Friday’s close at 23:00 GMT.

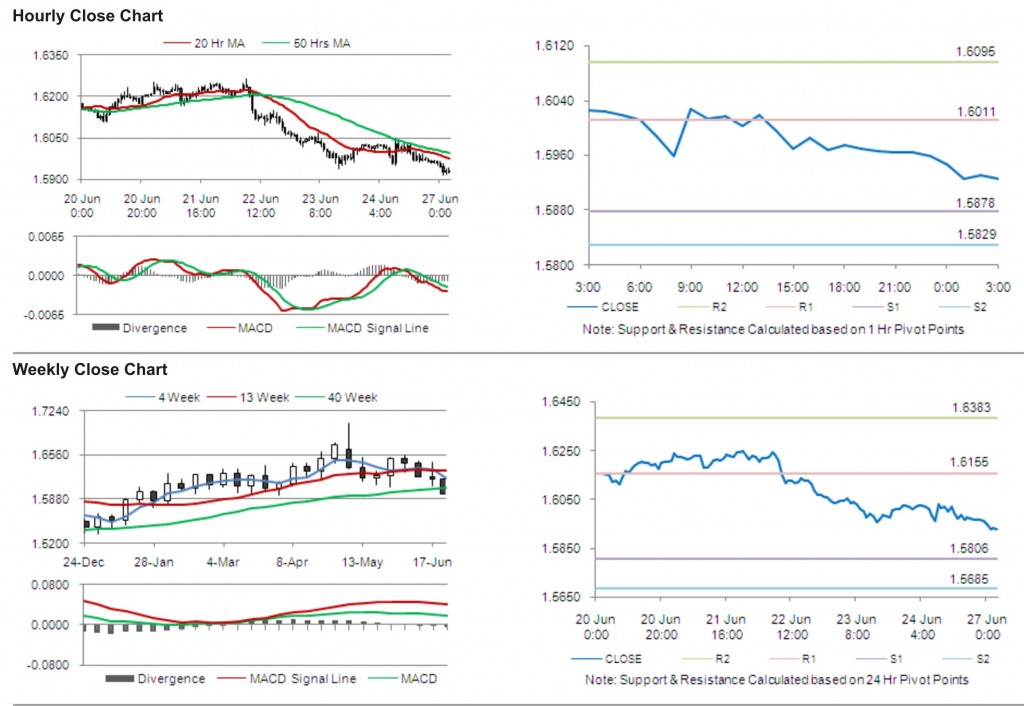

The pair has its first short term resistance at 1.6011, followed by the next resistance at 1.6095. The first support is at 1.5878, with the subsequent support at 1.5829.

The pair is expected to trade on the cues from the release of data on nationwide housing prices in the UK.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.