For the 24 hours to 23:00 GMT, GBP fell 0.54% against the USD and closed at 1.6162, as minutes from the Bank of England’s May 5 meeting showed the majority of policy makers warned against raising borrowing costs and after a report showed that unemployment claims rose.

The minutes of the Bank of England’s (BoE) Monetary Policy Committee (MPC) indicated that the MPC voted 6-3 to hold the key interest rate at its record low level of 0.5%. Meanwhile, the MPC voted 8-1 on the decision to maintain the size of asset purchases at £200.0 billion.

In the UK, the consumer confidence index fell to a reading of 43.0 in April, following an upwardly revised reading of 45.0 posted in March. Additionally, the number of people claiming Jobseeker’s Allowance increased by 12,400 on month to 1.47 million in April, the largest rise since January 2010, following a revised 6,400 increase recorded in March.

The pair opened the Asian session at 1.6162, and is trading at 1.6181 at 3.00GMT. The pair is trading 0.12% higher from the New York session close.

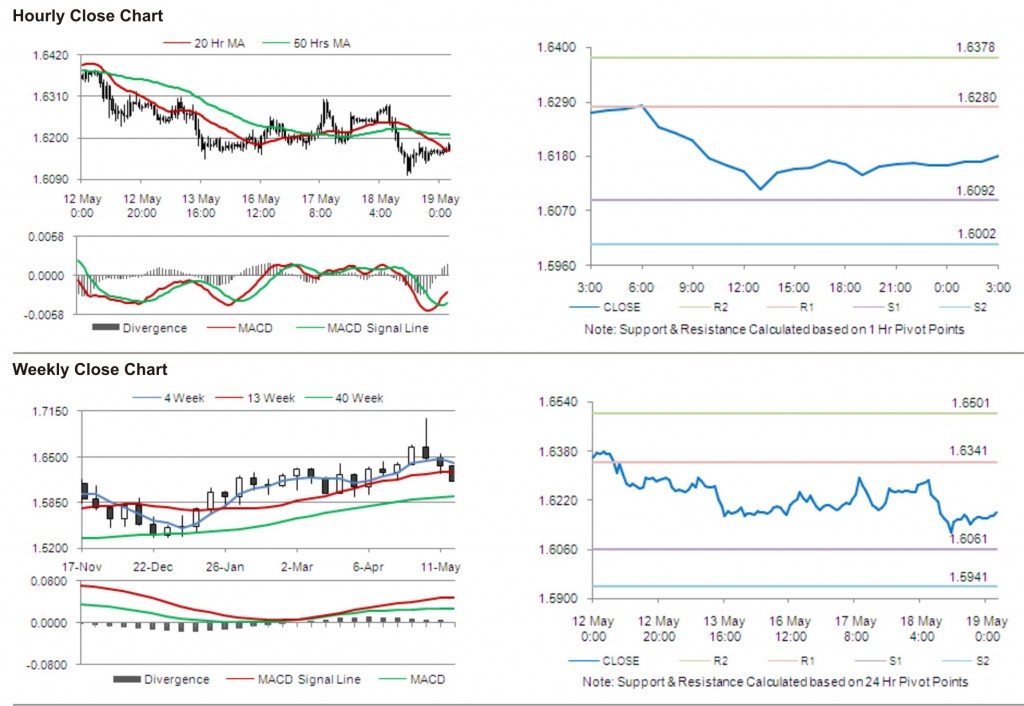

The pair has its first short term resistance at 1.6280, followed by the next resistance at 1.6378. The first support is at 1.6092, with the subsequent support at 1.6002.

Trading trends in the pair today are expected to be determined by data release on retail sales in the UK.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.