For the 24 hours to 23:00 GMT, GBP fell 0.21% against the USD and closed at 1.5433, after the Bank of England (BoE) stated that it would inject a further £75 billion into the economy through quantitative easing (QE). Meanwhile, policy makers decided to leave the benchmark interest rate unchanged at 0.50%.

In the UK, on a monthly basis, the Halifax House Price Index declined 0.5% in September, following a revised 1.1% decline recorded in August. On a seasonally adjusted annual basis, the services output index in the UK rose 1.3% in July. Additionally, on a month-on-month basis, services production rose 0.2% in July.

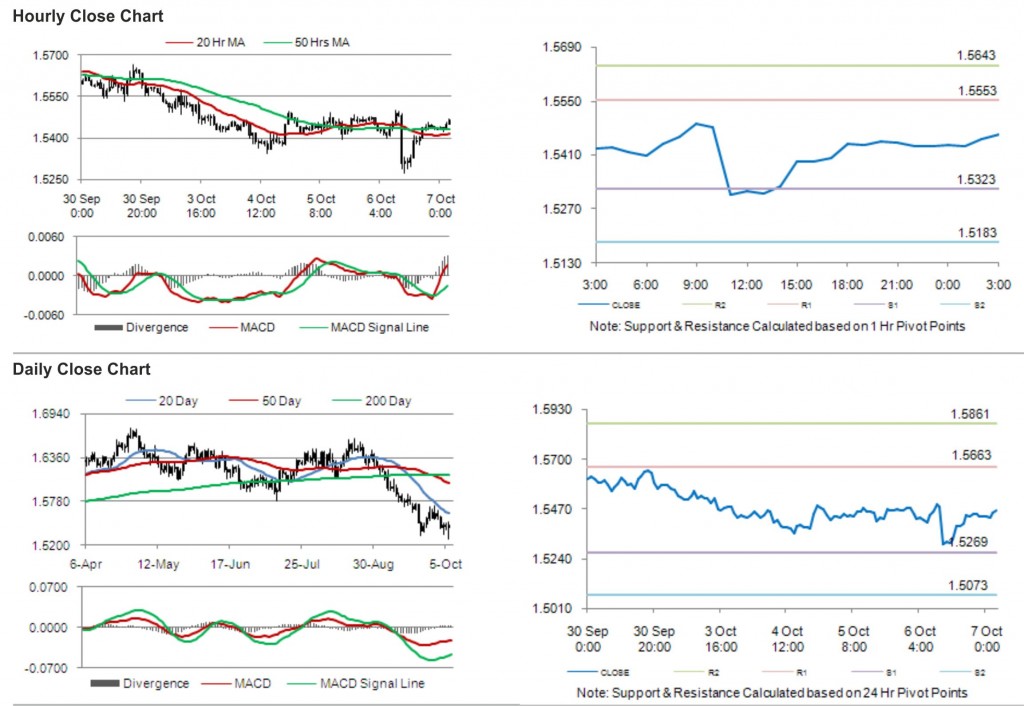

In the Asian session, at GMT0300, the pair is trading at 1.5464, with the GBP trading 0.20% higher from the New York close.

The pair is expected to find support at 1.5323, and a fall through could take it to the next support level of 1.5183. The pair is expected to find its first resistance at 1.5553, and a rise through could take it to the next resistance level of 1.5643.

The pair is expected to trade on the cues from the release of Producer Price Index (PPI) in the UK.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.