For the 24 hours to 23:00 GMT, GBP fell 0.25% against the USD and closed at 1.6397, after the Moody’s Investors Service stated that the Britain’s AAA credit rating could be threatened if growth remains weak and the government does not meet its deficit targets.

The pair opened the Asian session at 1.6397, and is trading at 1.6411 at 3.00GMT. The pair is trading 0.09% higher from yesterday’s close at 23:00 GMT.

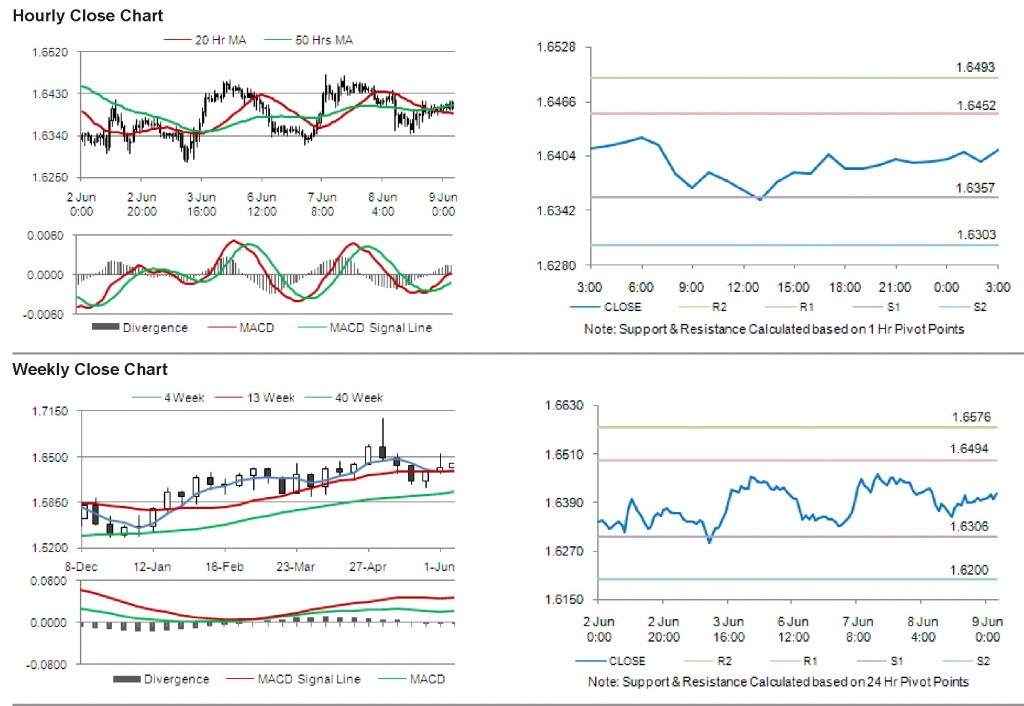

The pair has its first short term resistance at 1.6452, followed by the next resistance at 1.6493. The first support is at 1.6357, with the subsequent support at 1.6303.

BoE interest rate decision is likely to receive increased market attention, along with other UK economic data due to be released later today.

The currency pair is showing convergence with its 50 Hr moving average and is trading just above its 20 Hr moving average.