For the 24 hours to 23:00 GMT, GBP traded flat against the USD and closed at 1.5465.

Pound was initially pressurized, after a report showed that the economic growth slowed more than the market expectations in the last quarter, increasing pressure on the Bank of England (BoE) to keep interest rates low.

In the UK, the Gross Domestic Product (GDP) growth declined to 0.1% in the second quarter of 2011, compared to 0.4% growth in the previous quarter. On a seasonally adjusted basis, the services Purchasing Managers’ Index (PMI) rose to 52.9 in September, compared to 51.1 in August. Additionally, on a quarterly basis, the total business investment rose 11.6% in the second quarter of 2011 to £30.6 billion.

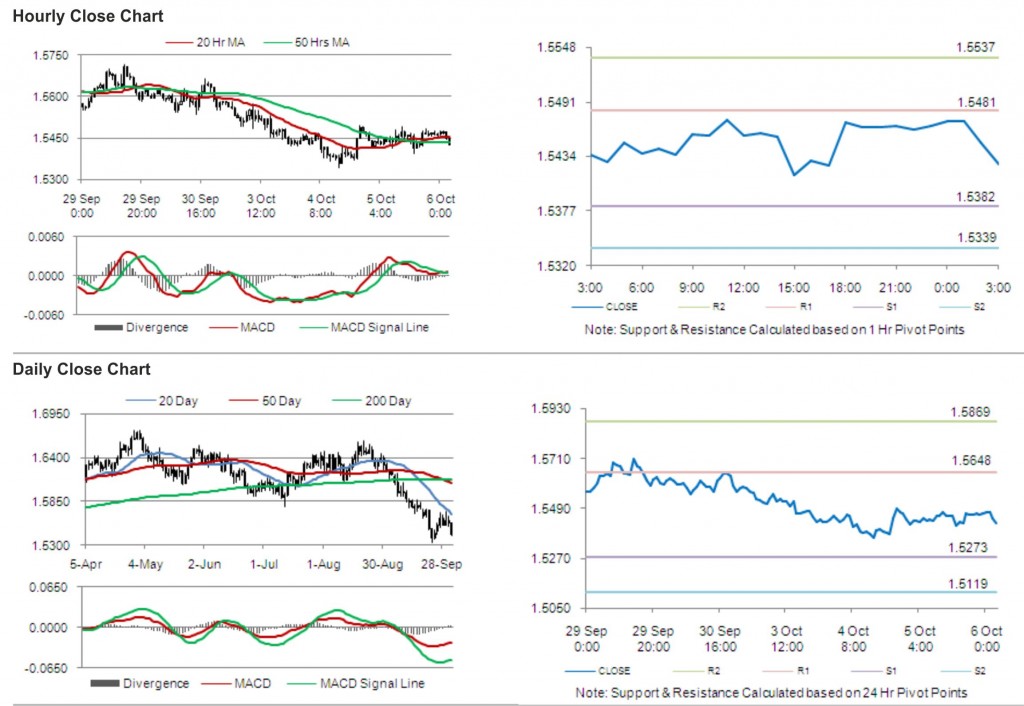

In the Asian session, at GMT0300, the pair is trading at 1.5426, with the GBP trading 0.25% lower from the New York close.

The pair is expected to find support at 1.5382, and a fall through could take it to the next support level of 1.5339. The pair is expected to find its first resistance at 1.5481, and a rise through could take it to the next resistance level of 1.5537.

Bank of England interest rate decision is likely to receive increased market attention, along with other economic releases in the UK, due to be released later today.

The currency pair is showing convergence with its 50 Hr moving average and is trading just below its 20 Hr moving average.