On Friday, GBP rose 0.20% against the USD and closed at 1.4964, on the back of upbeat employment data in the UK.

Data showed that Britain’s ILO unemployment rate dropped to 5.6% in the three months ended February, its lowest since 2008, from 5.7% in the September-November 2014 period. Additionally, claimant count rate in the nation registered a drop to 2.30% in March, compared to a level of 2.40% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.4968, with the GBP trading a tad higher from Friday’s close.

Earlier today, data showed that the Rightmove house price index in the UK advanced 1.6% MoM in April, compared to prior month’s rise of 1.0%.

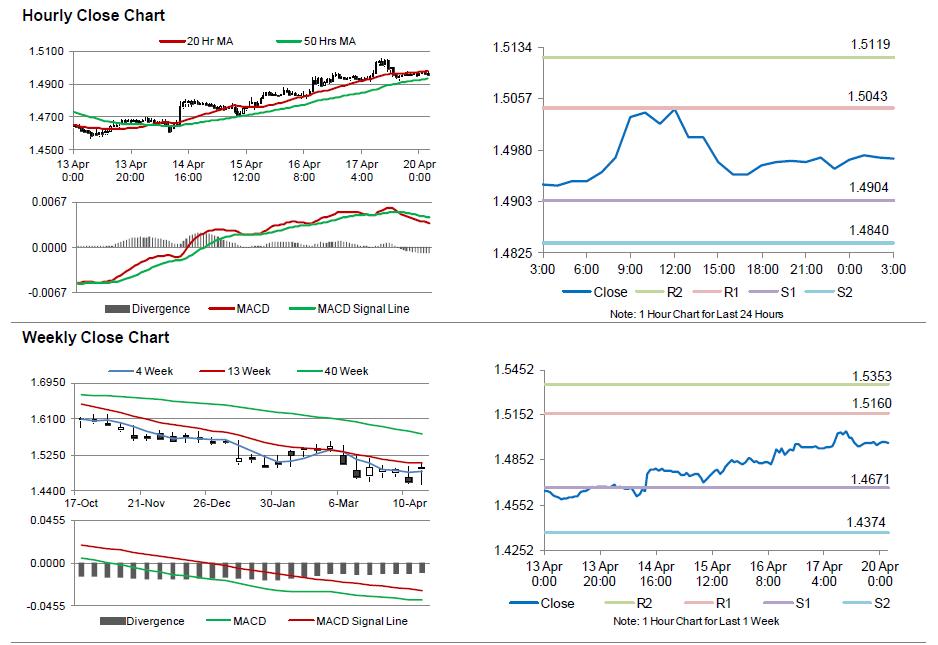

The pair is expected to find support at 1.4904, and a fall through could take it to the next support level of 1.484. The pair is expected to find its first resistance at 1.5043, and a rise through could take it to the next resistance level of 1.5119.

With no economic releases in the UK today, investors await the release of the BoE minutes, scheduled later in the week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.