For the 24 hours to 23:00 GMT, the GBP fell 0.11% against the USD and closed at 1.5995.

In economic news, the UK Nationwide house prices unexpectedly rose 0.5% on a monthly basis in October, higher than market expectations for a rise of 0.3% and reversing a 0.1% fall registered in September. Meanwhile, the UK’s Lloyds business barometer narrowed to 35.0 in October, compared to a level of 57.0 registered in the prior month.

Separately, the BoE’s Deputy Governor, Jon Cunliffe stated that the UK economy was on apath of strong growth, adding that the central bank would opt for a gradual increase in interest rates with an aim to support the recovery as long as possible.

In the Asian session, at GMT0400, the pair is trading at 1.5994, with the GBP trading a tad lower from yesterday’s close.

Earlier today, the GfK consumer confidence in Britain unexpectedly fell to -2.0 in October, following a level of -1.0 registered in September. Market anticipations were for the index to record a steady reading.

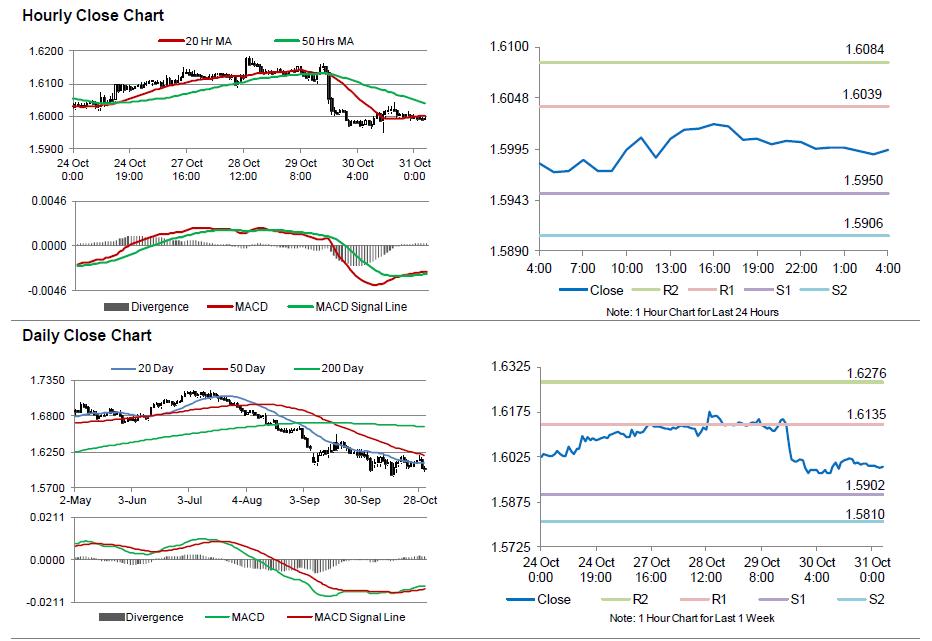

The pair is expected to find support at 1.5950, and a fall through could take it to the next support level of 1.5906. The pair is expected to find its first resistance at 1.6039, and a rise through could take it to the next resistance level of 1.6084.

Amid a light economic calendar from the UK today, investor sentiments would be governed by global macroeconomic news.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.