For the 24 hours to 23:00 GMT, the GBP declined 0.53% against the USD and closed at 1.3017 yesterday. In January, on a MoM basis, the seasonally adjusted house prices in the UK climbed to a 14-month high of 0.5%, compared to an advance of 0.1% in the prior month. Markets were expecting house prices to climb 0.3%.

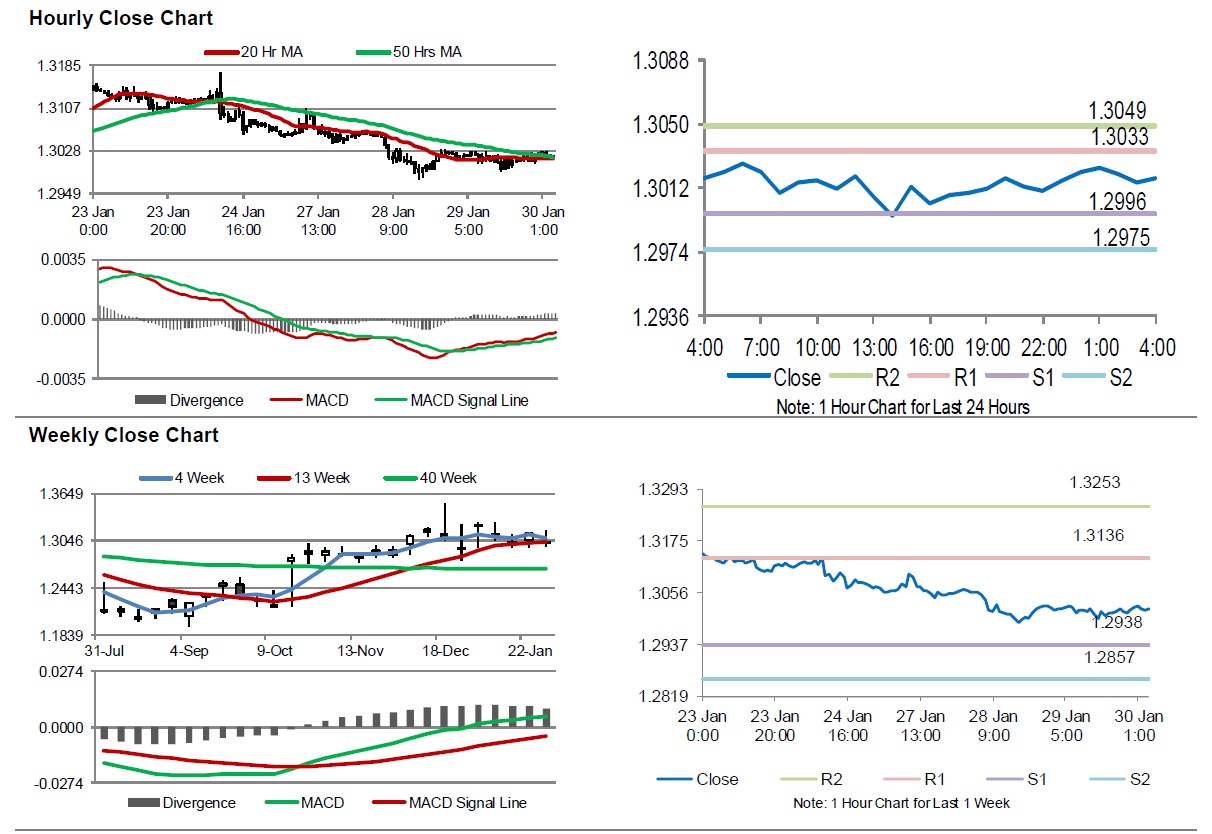

In the Asian session, at GMT0400, the pair is trading at 1.3018, with the GBP trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2996, and a fall through could take it to the next support level of 1.2975. The pair is expected to find its first resistance at 1.3033, and a rise through could take it to the next resistance level of 1.3049.

Looking ahead, traders would keep a close watch on the Bank of England’s (BoE) interest rate decision and quarterly inflation report. Also, the release of the BoE monetary policy summary will provide further direction to markets.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.