For the 24 hours to 23:00 GMT, GBP rose 0.22% against the USD and closed at 1.5958, on an upbeat UK house price data.

On an annual basis, the Nationwide Housing Prices in the UK rose 0.9% in February, compared to 0.6% recorded in the previous month. Meanwhile, the Manufacturing Purchasing Managers’ Index (PMI) in the UK stood at to 51.2 in February, compared to 52.0 in January.

The Bank of England policy maker, Martin Weale, stated that consumption in the UK “appears to be growing again” and recent economic indicators have been more positive, tempering the expectations of further stimulus.

In the Asian session, at GMT0400, the pair is trading at 1.5948, with the GBP trading 0.06% lower from yesterday’s close.

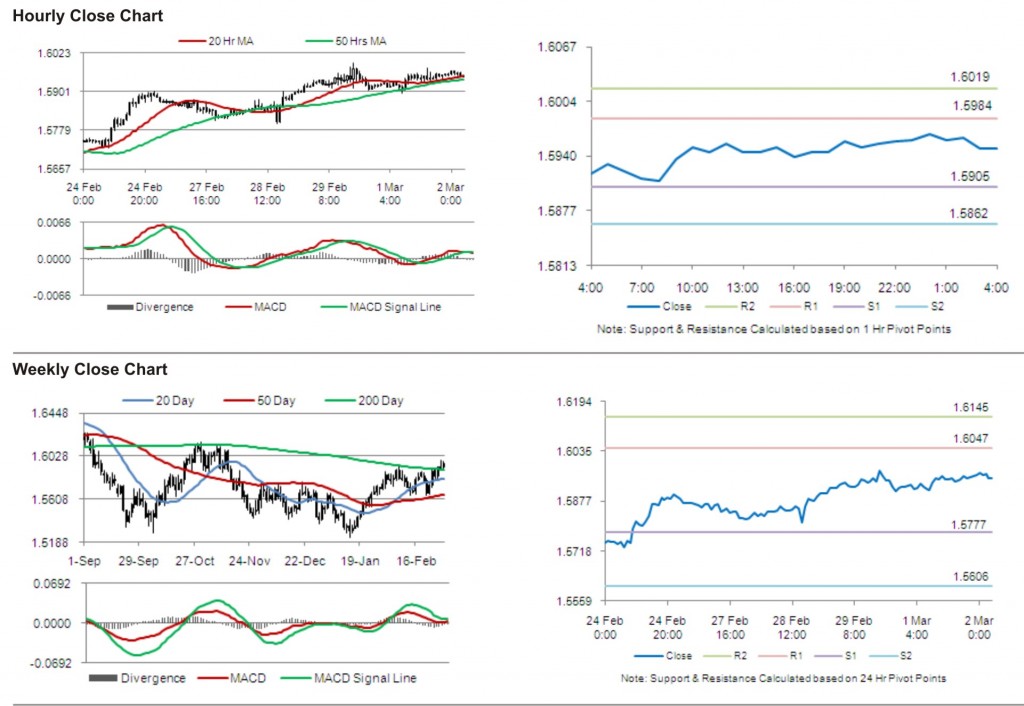

The pair is expected to find support at 1.5905, and a fall through could take it to the next support level of 1.5862. The pair is expected to find its first resistance at 1.5984, and a rise through could take it to the next resistance level of 1.6019.

The pair is expected to trade on the cues from the release of construction Purchasing Managers’ Index (PMI) and Halifax house prices data in the UK.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.