For the 24 hours to 23:00 GMT, the GBP remained flat against the USD and closed at 1.5609. In economic news, the construction activity in Britain expanded at its fastest rate in four months in June, indicating that pre-election uncertainty has eased among firms and consumers.

Data released showed that Britain’s construction PMI jumped to a level of 58.1 in June, beating market expectations of an advance to 56.5 and following a reading of 55.9 in the previous month.

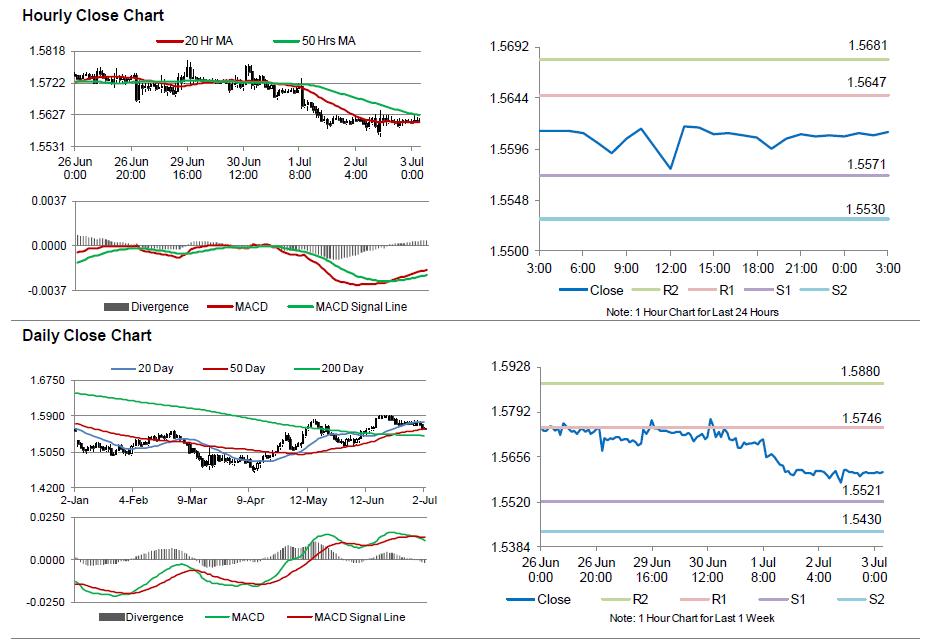

In the Asian session, at GMT0300, the pair is trading at 1.5612, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5571, and a fall through could take it to the next support level of 1.553. The pair is expected to find its first resistance at 1.5647, and a rise through could take it to the next resistance level of 1.5681.

Going forward, investors would concentrate on UK’s services PMI data, scheduled in a few hours to gauge the strength of the UK economy.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.