For the 24 hours to 23:00 GMT, the GBP fell 0.57% against the USD and closed at 1.5201, after UK’s manufacturing PMI missed market estimates in May.

Yesterday, the UK manufacturing PMI climbed less-than-expected to a level of 52.0 in May, compared to a seven-month low of 51.8, as the sector was hit by a combination of the strong pound and weak business investment spending.

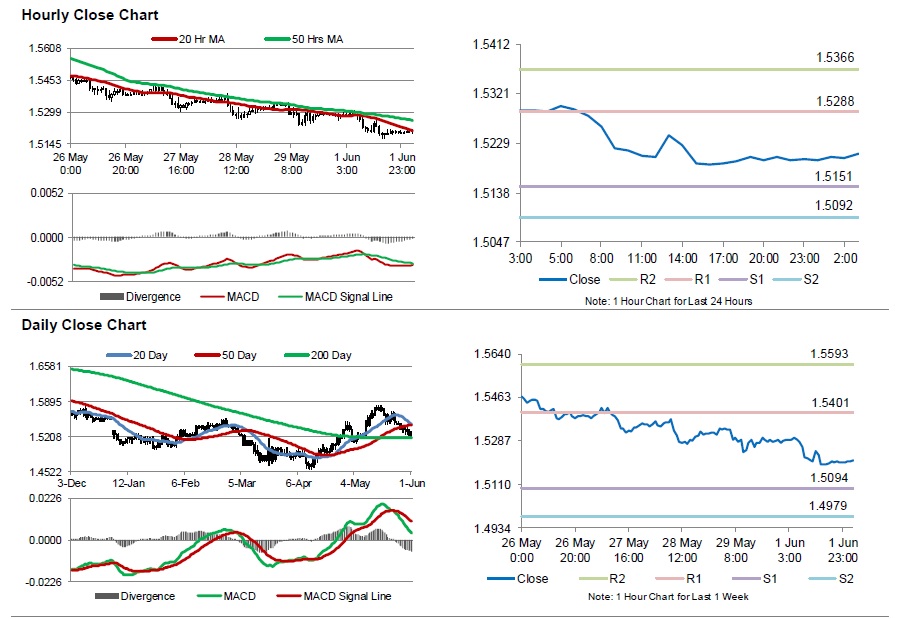

In the Asian session, at GMT0300, the pair is trading at 1.5209, with the GBP trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.5151, and a fall through could take it to the next support level of 1.5092. The pair is expected to find its first resistance at 1.5288, and a rise through could take it to the next resistance level of 1.5366.

Moving ahead, investors would closely monitor Britain’s construction PMI data, scheduled in a few hours for further direction in the currency pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.