On Friday, GBP marginally declined 0.09% against the USD and closed at 1.5058, following disappointing consumer credit data in the UK.

Consumer credit in the UK advanced less than expected to £0.58 billion in December, compared to a revised rise of £1.23 billion in the previous month. Market expectations were for it to climb £1.20 billion. Additionally, total lending to individuals increased by £2.2 billion on a MoM basis in December, growing at the slowest pace in more than a year and down from a rise of £3.3 billion in November.

In other economic news, mortgage approvals in the UK climbed for the first time in 6-months to 60.275 K mortgages in December, up from prior month’s level of 58.956K.

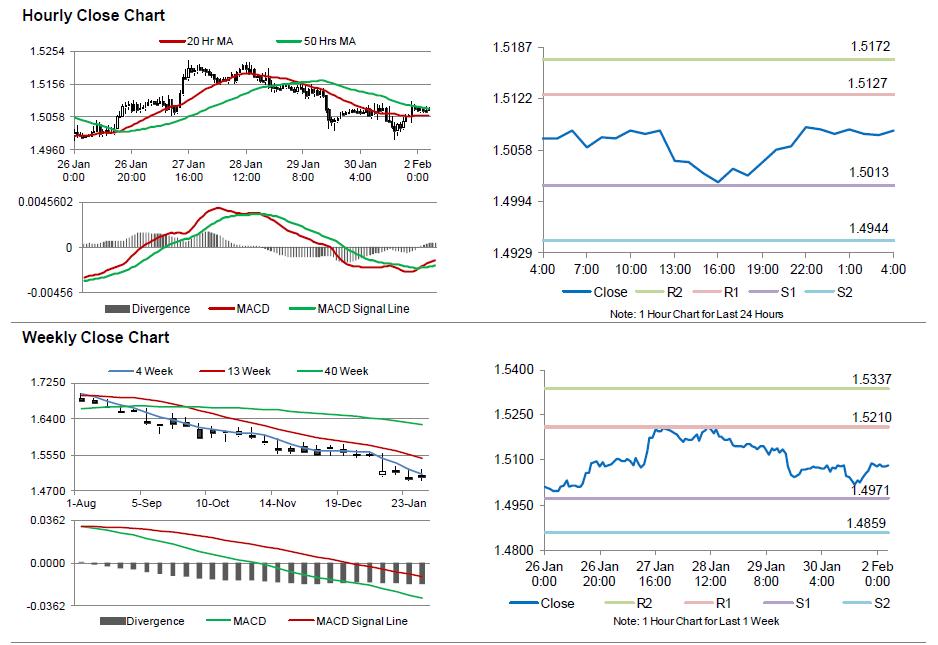

In the Asian session, at GMT0400, the pair is trading at 1.5083, with the GBP trading 0.16% higher from Friday’s close.

The pair is expected to find support at 1.5013, and a fall through could take it to the next support level of 1.4944. The pair is expected to find its first resistance at 1.5127, and a rise through could take it to the next resistance level of 1.5172.

Trading trends in the Pound today are expected to be determined by the UK Markit manufacturing PMI data, scheduled in few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.