On Friday, GBP rose 0.21% against the USD and closed at 1.5870.

In economic news, the UK’s total trade deficit widened to £2.84 billion in September, from a revised total trade deficit of £1.77 billion registered in August, while markets expected the nation’s total trade deficit to expand to £2.30 billion.

Separately, the BoE Governor, Mark Carney indicated that hike in interest rates in the UK would be limited and gradual. Further, he warned that as the central bank begins to hike its interest rates, the present “low volatility environment” would change.

In the Asian session, at GMT0400, the pair is trading at 1.5903, with the GBP trading 0.21% higher from Friday’s close.

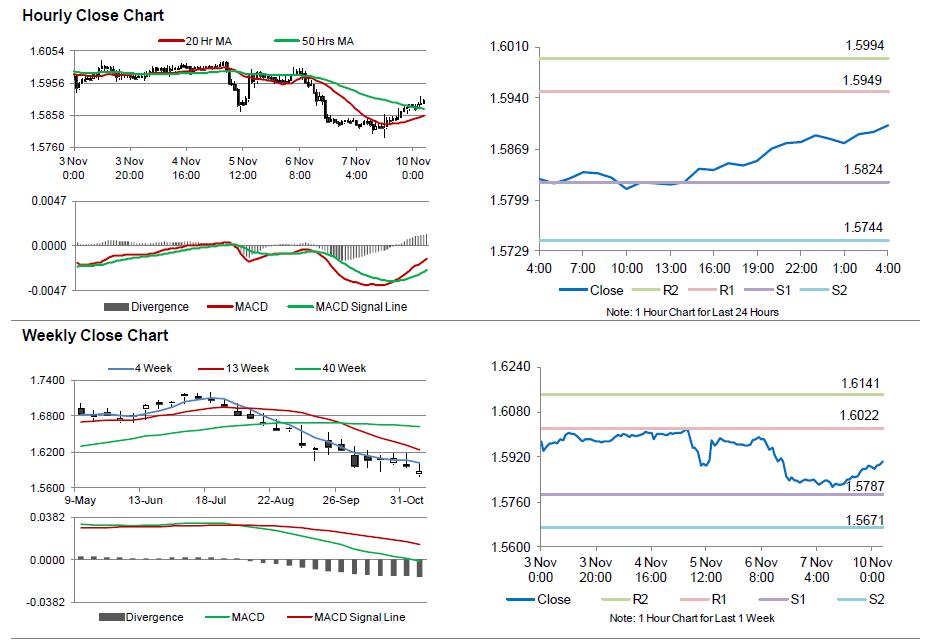

The pair is expected to find support at 1.5824, and a fall through could take it to the next support level of 1.5744. The pair is expected to find its first resistance at 1.5949, and a rise through could take it to the next resistance level of 1.5994.

Amid no economic data from the UK today, investors look ahead to the BoE Governor, Mark Carney’s speech scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.