For the 24 hours to 23:00 GMT, the GBP rose 0.17% against the USD and closed at 1.6257, after the consumer prices in the UK rebounded strongly in August and registered a rise of 0.4%, on a monthly basis, compared to a drop of 0.3% registered in the previous month. Additionally, the DCLG house price index in the nation rose to a 7-year high, increasing 11.7% on an annual basis in July, beating market expectations for a gain of 10.6% and compared to a rise of 10.2% in the previous month. Also, the UK retail price index came in line with the market expectations, registering a rise of 0.4%, on a monthly basis, in August. However, the producer prices fell 0.1% (MoM) in August.

In the Asian session, at GMT0300, the pair is trading at 1.6261, with the GBP trading tad higher from yesterday’s close.

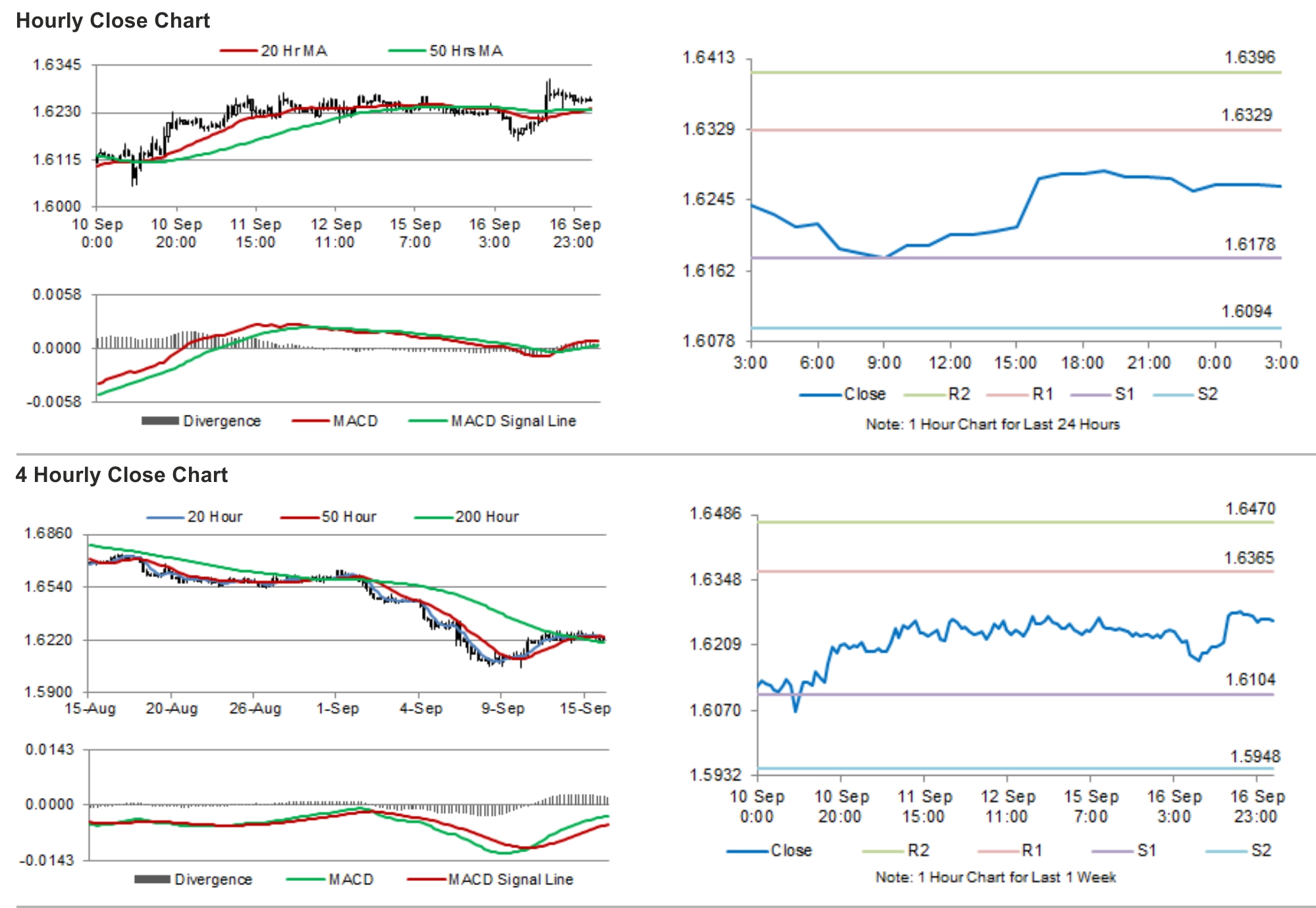

The pair is expected to find support at 1.6178, and a fall through could take it to the next support level of 1.6094. The pair is expected to find its first resistance at 1.6329, and a rise through could take it to the next resistance level of 1.6396.

Investors would keenly await BoE’s minutes of the latest policy meeting as well as voting pattern of the MPC members, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.