For the 24 hours to 23:00 GMT, the GBP fell 1.13% against the USD and closed at 1.5891, after consumer price index in the UK remained flat on a monthly basis in September, registering its lowest rate since October 2009, less than market expectations for a rise of 0.2%. The index had climbed 0.4% in the previous month.

In other economic news, the nation’s retail price index advanced 0.2% on a monthly basis in September, after registering a gain of 0.4% in August. Meanwhile, the DCLG house price index in the UK registered a rise of 11.7%, following a similar rise recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.5901, with the GBP trading 0.06% higher from yesterday’s close.

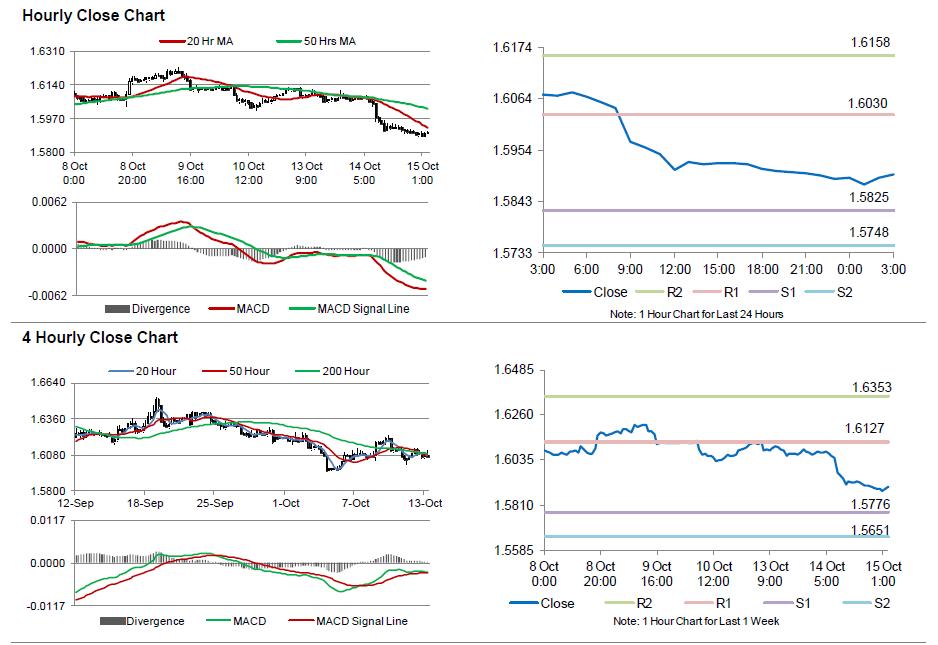

The pair is expected to find support at 1.5825, and a fall through could take it to the next support level of 1.5748. The pair is expected to find its first resistance at 1.6030, and a rise through could take it to the next resistance level of 1.6158.

Looking ahead, investors would keep a close eye on the UK’s crucial ILO unemployment rate as well as jobless claims data, scheduled for release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.