On Friday, the GBP is trading marginally lower against the USD and closed at 1.5510.

In economic news, UK BBA mortgage approvals notched a 15-month high level of 44.48K in June, compared to a revised reading of 42.87 K in the previous month, while markets were expecting it to climb to a level of 43.30 K, indicating that the nation’s housing market was heating up again.

In the Asian session, at GMT0300, the pair is trading at 1.5528, with the GBP trading 0.11% higher from Friday’s close.

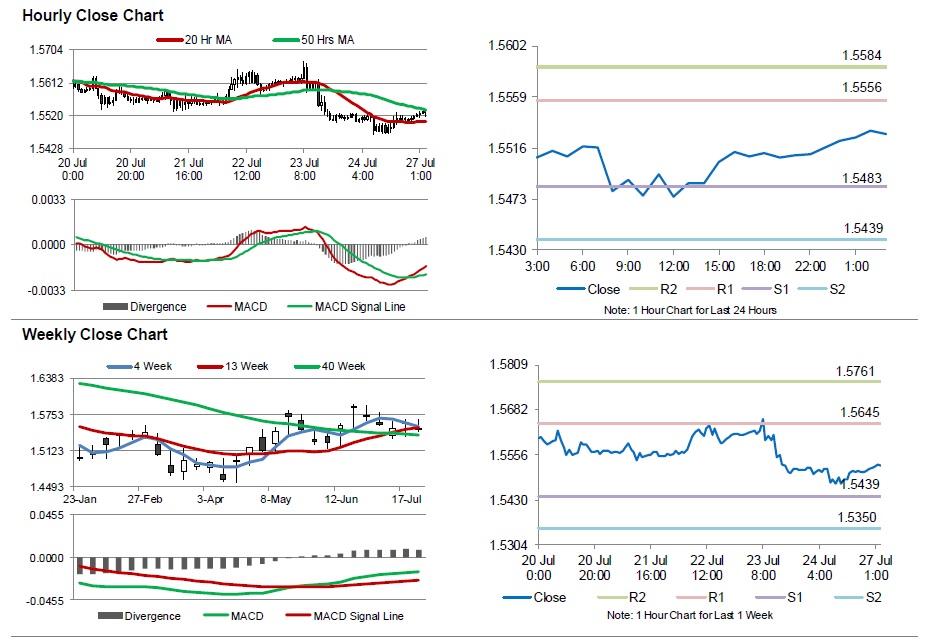

The pair is expected to find support at 1.5483, and a fall through could take it to the next support level of 1.5439. The pair is expected to find its first resistance at 1.5556, and a rise through could take it to the next resistance level of 1.5584.

Looking ahead, market participants await the much anticipated preliminary second quarter UK GDP data, scheduled tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.