For the 24 hours to 23:00 GMT, the GBP rose 0.48% against the USD and closed at 1.5658. Meanwhile, July’s consumer prices slid 0.20% MoM in the UK, lower than market expectations for a fall of 0.30%. The consumer price index had recorded a flat reading in the previous month. Additionally, the UK’s non-seasonally adjusted PPI core output unexpectedly advanced 0.10% in July, higher than market expectations for a steady reading. The house price index rose 5.70% YoY in the UK. In the previous month, the house price index had registered a revised rise of 5.60% in June.

In the Asian session, at GMT0300, the pair is trading at 1.5673, with the GBP trading 0.1% higher from yesterday’s close.

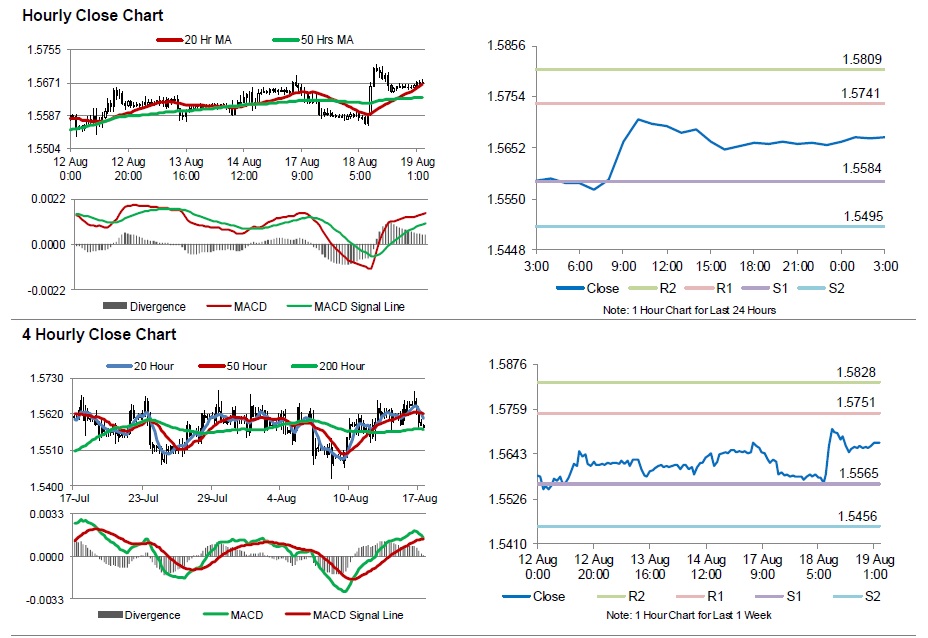

The pair is expected to find support at 1.5584, and a fall through could take it to the next support level of 1.5495. The pair is expected to find its first resistance at 1.5741, and a rise through could take it to the next resistance level of 1.5809.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.