On Friday, the GBP declined 0.07%against the USD and closed at 1.5429, after the consumer inflation expectations in the UK for the next 12 months dipped to 2.0% from a level of 2.2% estimated earlier.

In other economic news, construction output in the UK unexpectedly dropped 1.0% on a monthly basis in July, compared to prior month’s increase of 0.9%.

In the Asian session, at GMT0300, the pair is trading at 1.5449, with the GBP trading 0.13% higher from Friday’s close.

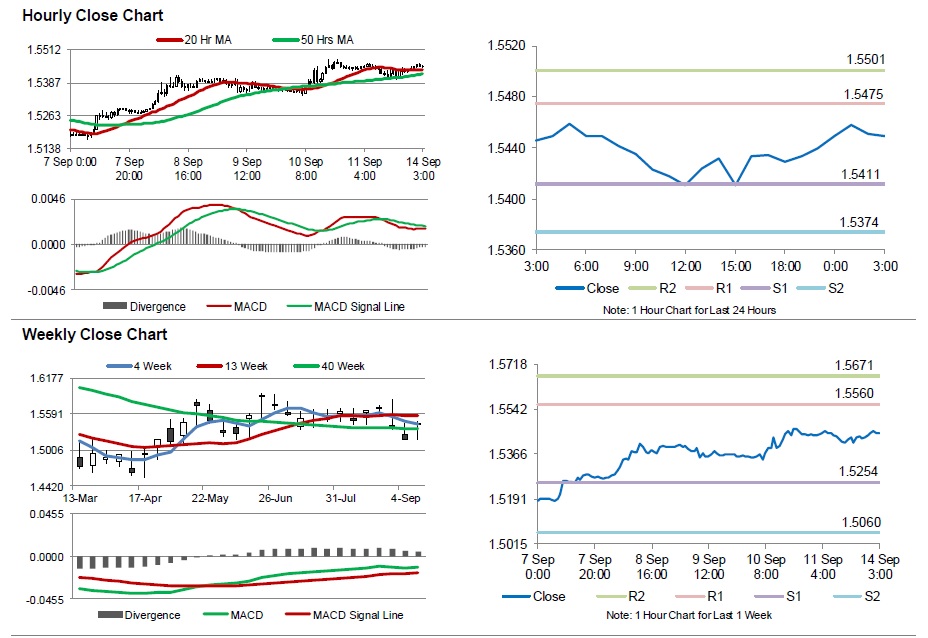

The pair is expected to find support at 1.5411, and a fall through could take it to the next support level of 1.5374. The pair is expected to find its first resistance at 1.5475, and a rise through could take it to the next resistance level of 1.5501.

Amid no economic releases in UK today, investors would keep a close eye on the nation’s consumer price inflation data, scheduled tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.