On Friday, GBP marginally declined 0.37% against the USD and closed at 1.6059, after Britain’s construction output unexpectedly declined 0.3% on an annual basis in August, less than market expectations for a rise of 2.9% and compared to a revised rise of 4.3% registered in July.

In other economic news, the UK’s total trade deficit narrowed to £1.92 billion in August, following a revised trade deficit of £3.08 billion in July. Markets were anticipating the nation to post a total trade deficit of £3.0 billion. Additionally, the CB leading economic index advanced 0.4% on a monthly basis in August, after registering 0.1% gain in the prior month.

The newest BoE policymaker, Kristin Forbes emphasised that inflationary issues in the UK economy were stagnating growth in the region.

In the Asian session, at GMT0300, the pair is trading at 1.612, with the GBP trading 0.38% higher from Friday’s close.

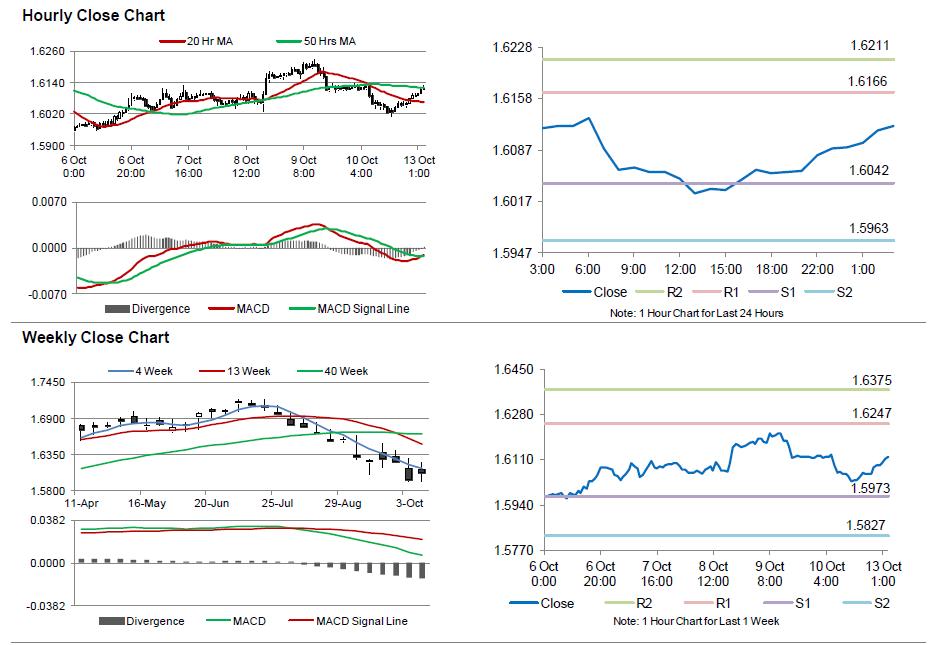

The pair is expected to find support at 1.6042, and a fall through could take it to the next support level of 1.5963. The pair is expected to find its first resistance at 1.6166, and a rise through could take it to the next resistance level of 1.6211.

Amid a thin economic calendar from the UK today, investor sentiments would be governed by economic news from other countries.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.