For the 24 hours to 23:00 GMT, the GBP marginally fell against the USD and closed at 1.6737, paring its initial gains accrued on the back of a better-than-expected UK service PMI data for May. Markit Economics reported that employment growth in the UK service sector strengthened to match a 17-year high level in May even as its PMI edged down slightly to a reading of 58.6 in May, less than analysts’ expectations for a decline to a level of 58.2.

Meanwhile, a BoE’s Financial Policy Committee member, Richard Sharp, opined that, despite the recent-growing optimism on UK’s economic growth, the economy still remained in a fragile position with a variety of risks to its financial system.

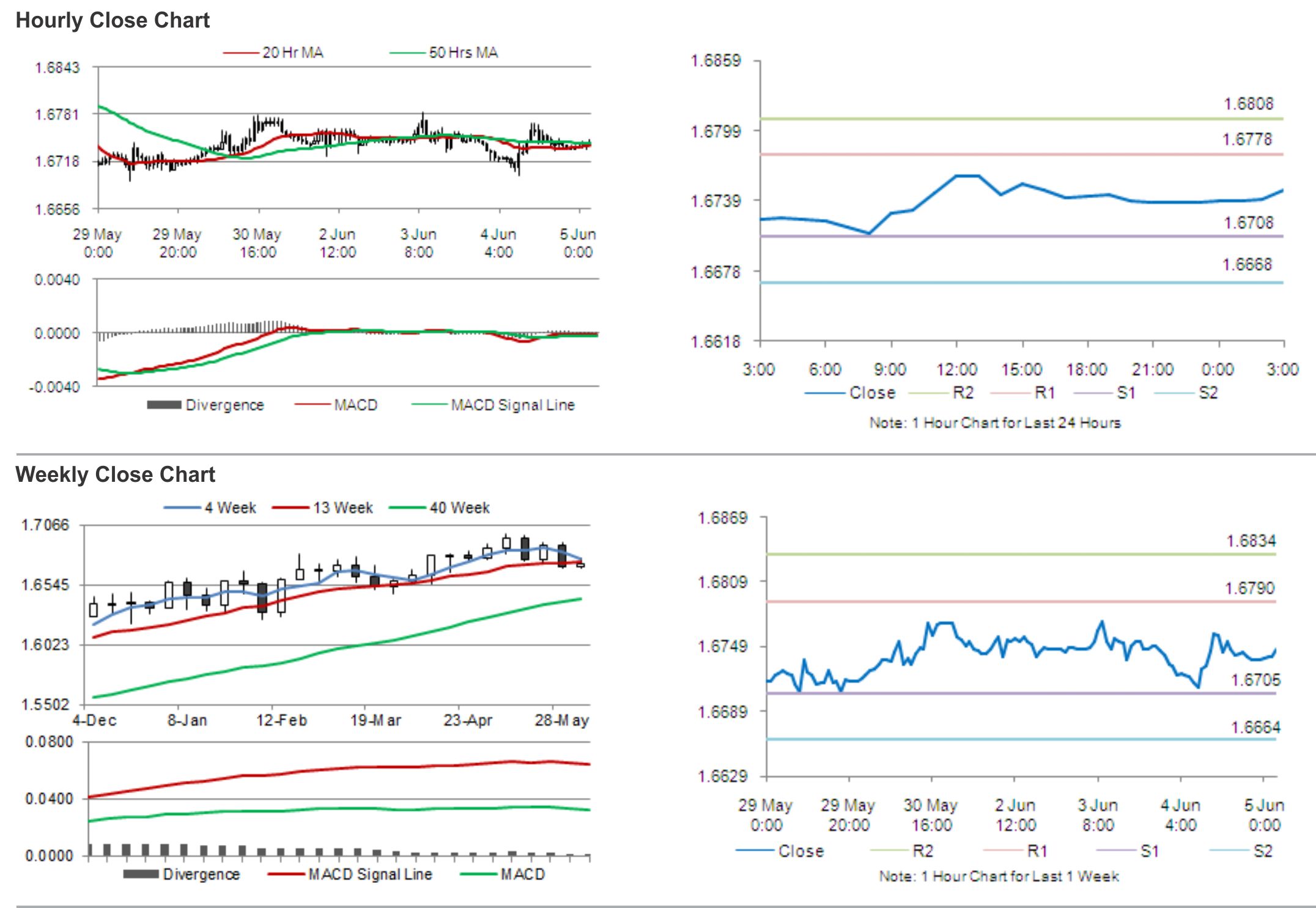

In the Asian session, at GMT0300, the pair is trading at 1.6747, with the GBP trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.6708, and a fall through could take it to the next support level of 1.6668. The pair is expected to find its first resistance at 1.6778, and a rise through could take it to the next resistance level of 1.6808.

Market participants keenly await the BoE’s interest rate and QE policy decision, later today, for further guidance in the British Pound.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.