For the 24 hours to 23:00 GMT, GBP fell 0.45% against the USD and closed at 1.5785.

Bank of England policy maker Adam Posen stated that he may need to double his call for bond purchases which would further intensify the debate at the UK central bank for more stimulus as the economy falters.

In the economic news in the UK, on a monthly basis, the consumer price index rose 0.6% in August and following a flat reading recorded in the previous month. The retail price inflation rose to 5.2% in August, compared to a rate of 5.0% recorded in July. The house price index declined 1.5% (Y-o-Y) in July, compared to a 2.0% fall recorded in June. Additionally, the trade deficit remained unchanged at £8.9 billion in July compared to previous month.

The pair opened the Asian session at 1.5785, and is trading at 1.5765 at 3.00GMT. GBP is trading 0.13% lower versus USD from yesterday’s close at 23:00 GMT.

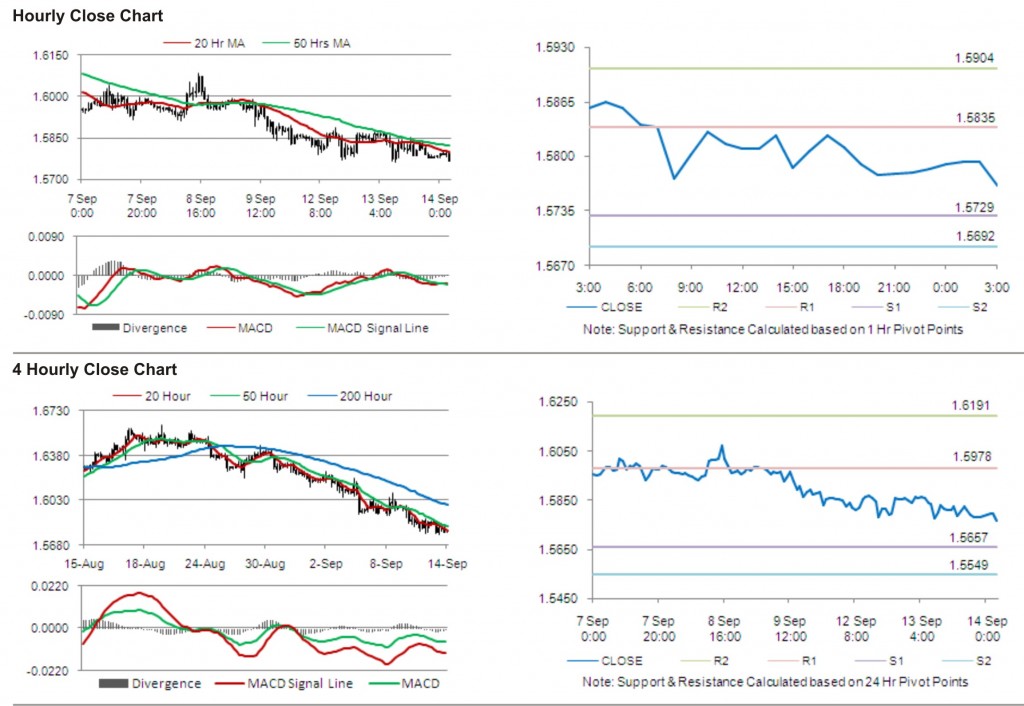

The pair has its first short term resistance at 1.5835, followed by the next resistance at 1.5904. The first support is at 1.5729, with the subsequent support at 1.5692.

The pair is expected to trade on the cues from the release of employment data in the UK.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.