On Friday, GBP declined 0.32% against the USD and closed at 1.6778, after the release of downbeat trade balance data from the UK. Official data showed that the British trade deficit widened to £9.41 billion in June, from £9.15 billion in May. Analysts had expected the trade deficit to narrow to £8.90 billion in June.

Meanwhile, the construction output delivered a strong performance than the market expectations, after the output rose 1.2% in June, on monthly basis, after it declined 1.2%, a month earlier. The markets had expected it to rise by 1.0%.

In the Asian session, at GMT0300, the pair is trading at 1.6782, with the GBP trading tad higher from yesterday’s close.

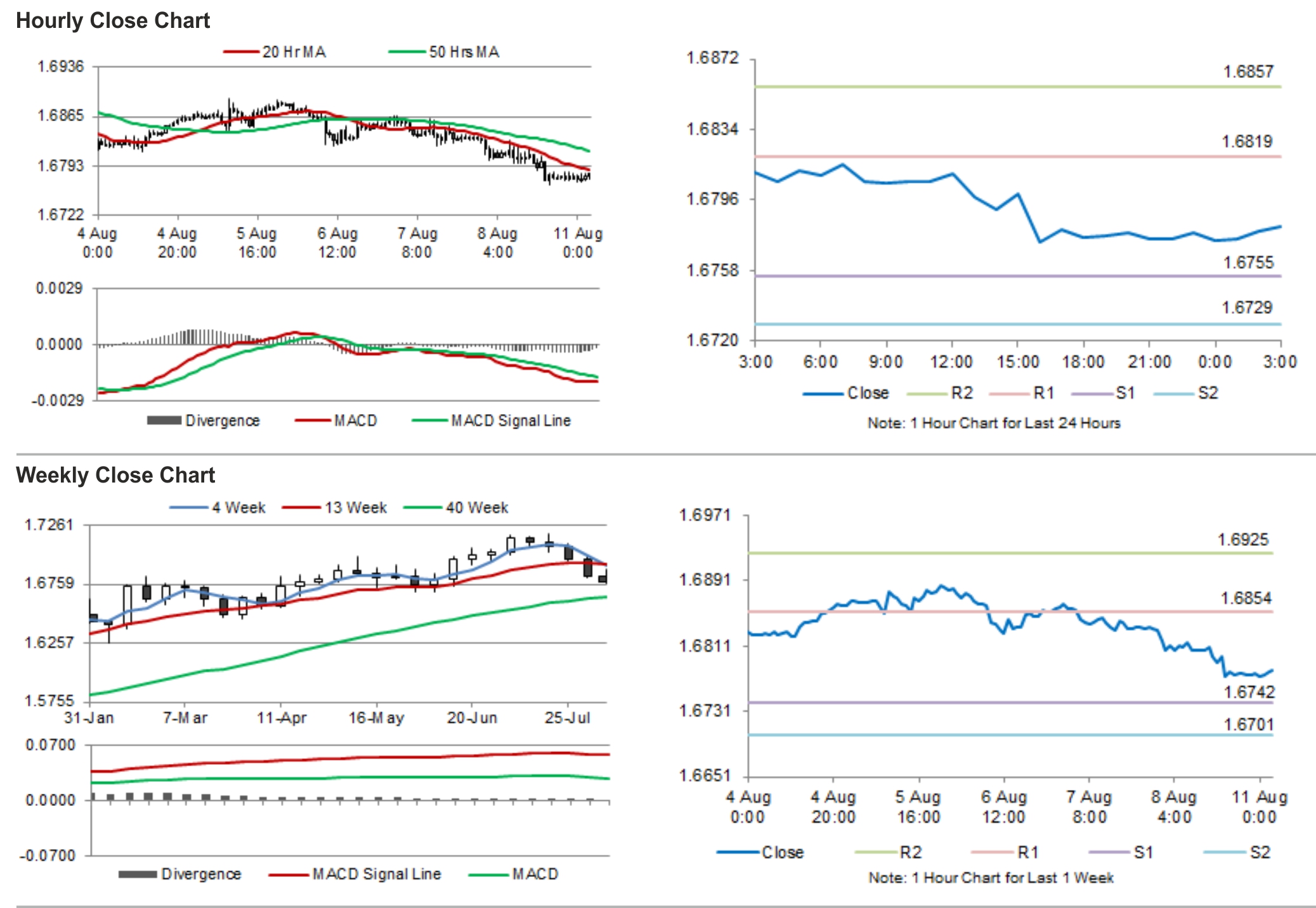

The pair is expected to find support at 1.6755, and a fall through could take it to the next support level of 1.6729. The pair is expected to find its first resistance at 1.6819, and a rise through could take it to the next resistance level of 1.6857.

Investors will wait for the release of UK’s CB leading economic index result, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.