For the 24 hours to 23:00 GMT, the GBP rose 0.67% against the USD and closed at 1.5748. Gains were kept in check following downbeat CPI data in the UK.

Britain’s annual inflation rate eased more than expected to 1.0% in November, hitting its lowest rate since September 2012 and below market expectations of a drop to 1.2%. This followed a 1.3% increase registered in the prior month. Meanwhile, the nation’s retail price index unexpectedly dropped 0.2% on a monthly basis in November, lower than market expectations for a flat reading.

Separately, the BoE Governor, Mark Carney stated that falling crude oil prices would prove beneficial to global as well as the UK’s economic growth, but added that the decline also suggested some risks to financial stability.

Yesterday, the BoE’s stress test results revealed that Royal Bank of Scotland and Lloyds Banking Group managed to scrape past the central bank’s stress test, while still remaining susceptible to a severe economic downturn. Additionally, it further cautioned in its semi-annual Financial Stability report, that persistent low growth and inflation in the Euro-zone economy could pose a threat to the UK economy and its financial system.

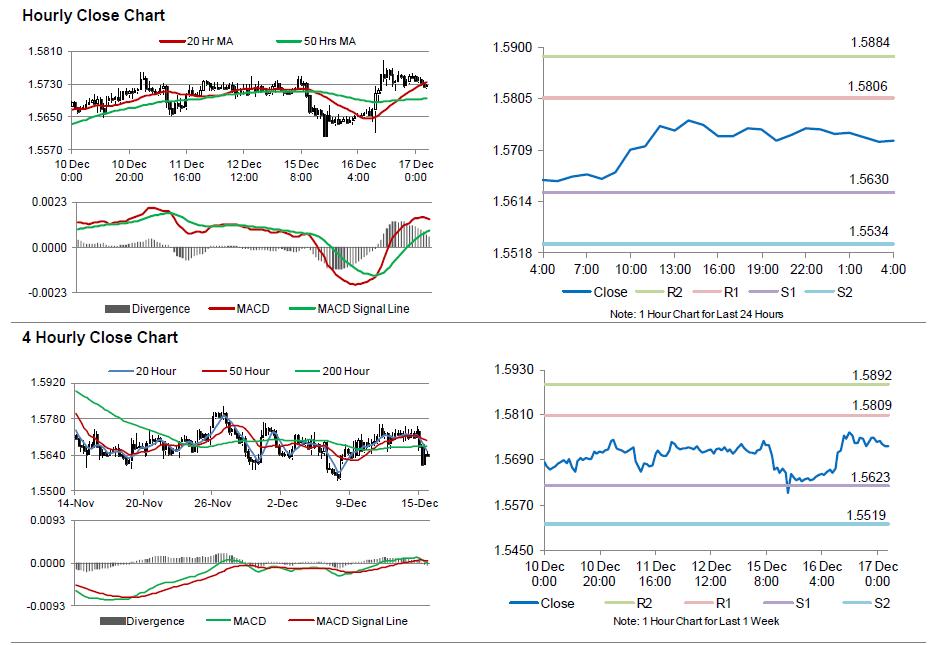

In the Asian session, at GMT0400, the pair is trading at 1.5727, with the GBP trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.5630, and a fall through could take it to the next support level of 1.5534. The pair is expected to find its first resistance at 1.5806, and a rise through could take it to the next resistance level of 1.5884.

Trading trends in the Pound today are expected to be determined by the BoE minutes from its latest monetary policy meeting coupled with the UK’s ILO unemployment rate data, scheduled in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.