For the 24 hours to 23:00 GMT, the GBP rose 0.31% against the USD and closed at 1.5685, following stronger than expected services PMI data in the UK.

The UK services PMI rose to a level of 58.6 in November, registering its fastest pace of expansion in 12-months and beating market expectations of a rise to a level of 56.5. In the previous month, the services PMI had registered a level of 56.20.

Yesterday, the UK Chancellor, George Osborne stated that the UK economy is the best performing economy among the G-7 countries of the world and raised the nation’s economic growth to 3% in 2014, from the previous 2.7% estimated expansion, although growth is expected to slow down to 2.4% in 2015.

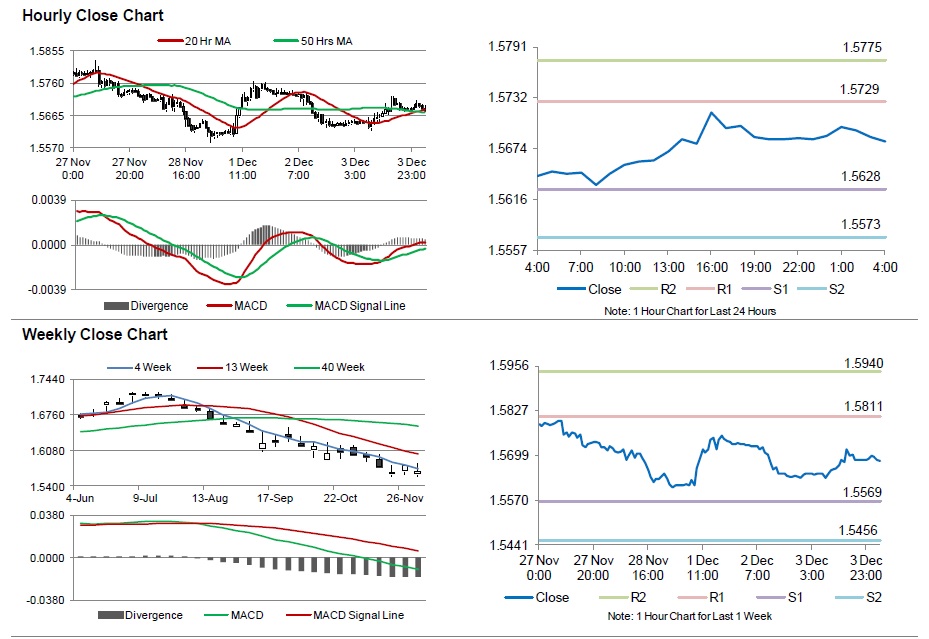

In the Asian session, at GMT0400, the pair is trading at 1.5682, with the GBP trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.5628, and a fall through could take it to the next support level of 1.5573. The pair is expected to find its first resistance at 1.5729, and a rise through could take it to the next resistance level of 1.5775.

Going forward, market participants would keep a tab on the BoE’s crucial interest rate decision, scheduled later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.