For the 24 hours to 23:00 GMT, the GBP traded tad lower against the USD and closed at 1.6463.

In economic news, the service sector activity in the UK expanded at the fastest pace in 10 months in August, pointing to a continued strong recovery in the sector. The services PMI in the nation jumped to 60.5 in August, from a reading of 59.1 registered in the previous month. Markets had expected the index to decline to 58.5. Additionally, composite PMI in the UK climbed to 59.3 in August, from 58.6 recorded in July. Meanwhile, official reserves in the UK recorded a drop of $377.0 million in August, compared to a fall of $616.0 million registered in the previous month.

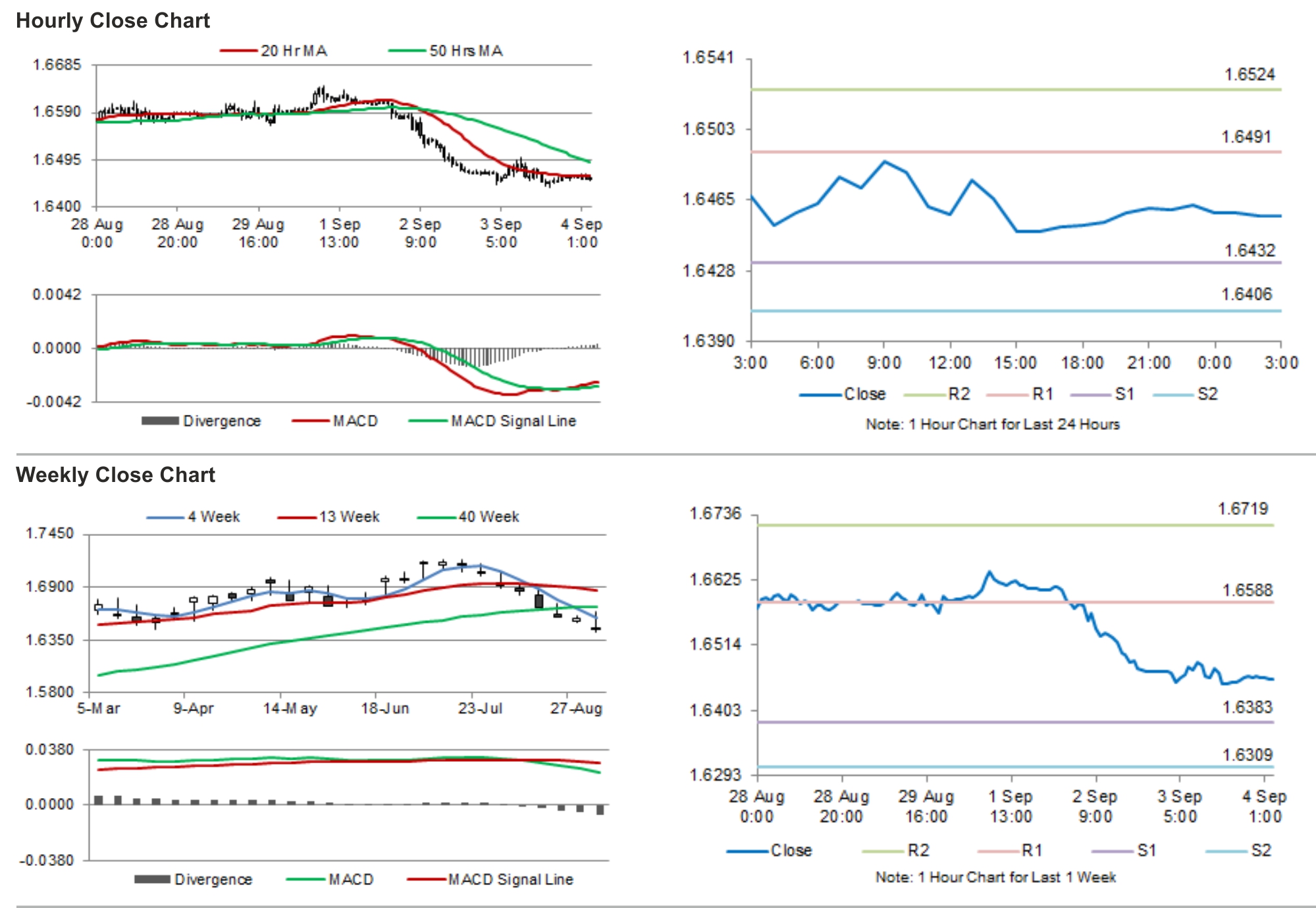

In the Asian session, at GMT0300, the pair is trading at 1.6457, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.6432, and a fall through could take it to the next support level of 1.6406. The pair is expected to find its first resistance at 1.6491, and a rise through could take it to the next resistance level of 1.6524.

Trading trends in the Pound today are expected to be determined by the BoE’s crucial interest rate decision, scheduled later today.

The currency pair is showing convergence with its 20 Hr and trading below its 50 Hr moving average.