For the 24 hours to 23:00 GMT, the GBP fell 0.58% against the USD and closed at 1.4808.

In economic news, number of mortgage approvals for house purchases in Britain rose more than market expectations to a level of 61.8 K in February, following a revised reading of 60.7 K recorded in the previous month. Meanwhile, net consumer credit in the nation advanced by £0.74 billion in February, compared to a revised advance of £0.80 billion in the previous month. Market expectations were expecting net consumer credit to rise by £0.90 billion.

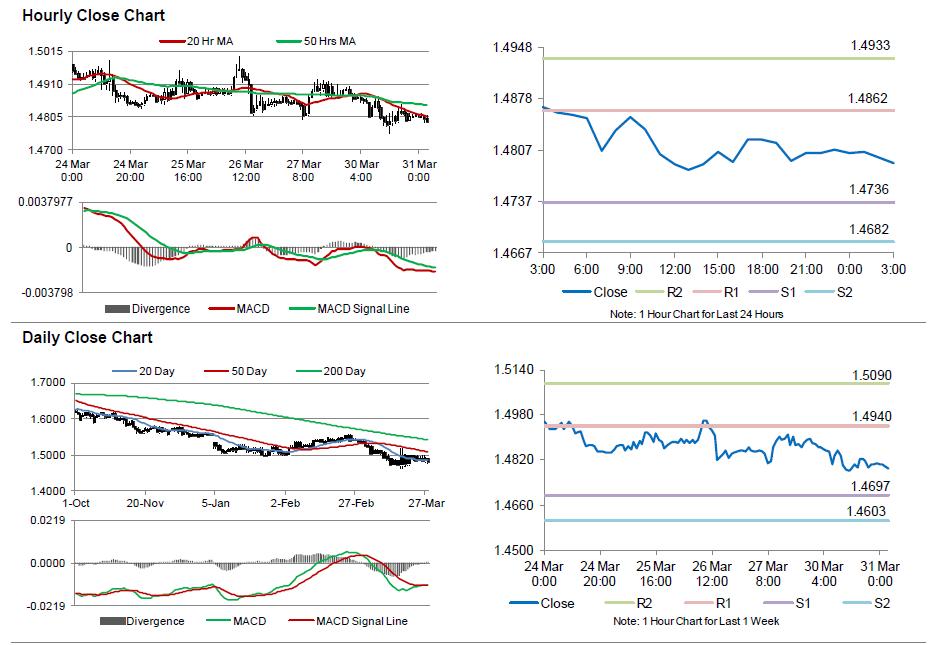

In the Asian session, at GMT0300, the pair is trading at 1.4790, with the GBP trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.4736, and a fall through could take it to the next support level of 1.4682. The pair is expected to find its first resistance at 1.4862, and a rise through could take it to the next resistance level of 1.4933.

Going forward, most market attention is focused on the final fourth quarter GDP data in the UK, scheduled in a few hours which is expected to remain unrevised.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.