For the 24 hours to 23:00 GMT, the GBP traded a tad higher against the USD and closed at 1.5639.

Yesterday, data showed that unemployment in the UK unexpectedly rose to 5.6% in the three months ended May, registering its first increase since Dec 2013 and compared to 5.5% registered in the previous period. However, average weekly earnings including bonuses picked up pace and advanced at the fastest pace since June 2009 in the three month period ended May. This improvement in the nation’s wage growth would somehow encourage the BoE to opt for an interest rate hike in its upcoming monetary policy meetings.

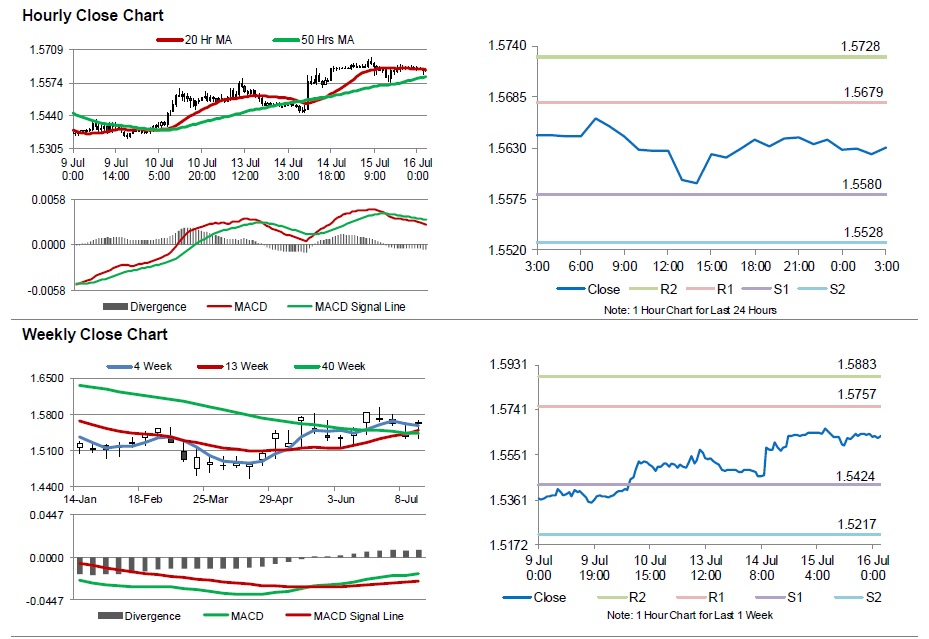

In the Asian session, at GMT0300, the pair is trading at 1.5631, with the GBP trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.558, and a fall through could take it to the next support level of 1.5528. The pair is expected to find its first resistance at 1.5679, and a rise through could take it to the next resistance level of 1.5728.

With no major economic releases in the UK today, investor sentiment would be governed by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.