For the 24 hours to 23:00 GMT, the GBP rose 0.27% against the USD and closed at 1.5717, after Britain’s total trade deficit dropped more than anticipated to £2.02 billion in October, compared to a revised deficit of £2.82 billion recorded in the prior month. Markets were expecting the nation to post a total trade deficit of £2.40 billion.

Separately, the BoE’s Monetary Policy Committee Member, Ian McCafferty opined that the central bank should start increasing its benchmark interest rate sooner rather than later and keep in mind that the hike should be “limited” and “gradual”.

Yesterday, the British Chambers of Commerce projected the UK economy to grow 3% this year, as compared to its earlier projection of 3.2%; however the growth would be at its fastest pace in seven years. Additionally, the business lobby group cautioned that a premature interest rate hike could present a “huge risk” to the British economy.

In the Asian session, at GMT0400, the pair is trading at 1.5715, with the GBP trading a tad lower from yesterday’s close.

Earlier today, the RICS house price balance in the UK dropped to a reading of 13.0 in November, compared to market expectations of a drop to a level of 15.0. In the previous month, the house price balance had recorded a reading of 20.0

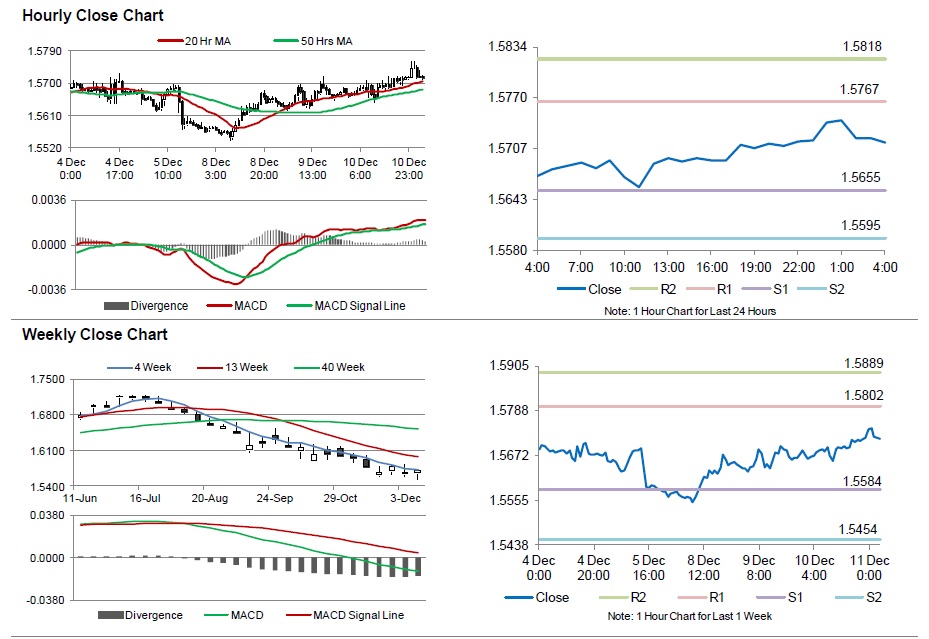

The pair is expected to find support at 1.5655, and a fall through could take it to the next support level of 1.5595. The pair is expected to find its first resistance at 1.5767, and a rise through could take it to the next resistance level of 1.5818.

Amid no economic releases in the UK today, market sentiment would be governed by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.