For the 24 hours to 23:00 GMT, the GBP traded marginally higher against the USD and closed at 1.5134, after manufacturing activity in the UK quickened more than anticipated in September.

Data showed that UK’s seasonally adjusted manufacturing PMI slightly fell to a level of 51.5 in September, albeit better than market expectations for a drop to a reading of 51.3.

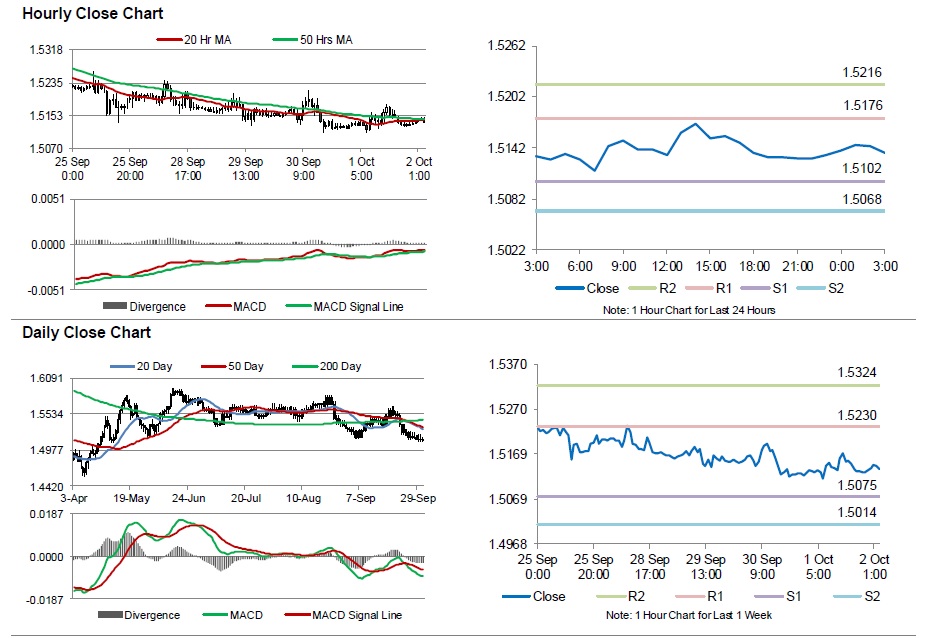

In the Asian session, at GMT0300, the pair is trading at 1.5136, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.5102, and a fall through could take it to the next support level of 1.5068. The pair is expected to find its first resistance at 1.5176, and a rise through could take it to the next resistance level of 1.5216.

Meanwhile, UK’s construction PMI data, scheduled in a few hours would come under investors’ radar, to get better insights in the nation economy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.