For the 24 hours to 23:00 GMT, the GBP fell 0.28% against the USD and closed at 1.5117.

On Friday, data showed that the manufacturing PMI in the UK unexpectedly fell to a 7-month low reading of 51.9 in April, compared to a level of 54.0 registered in March, while markets were expecting the index to rise to 54.6.

Other economic data indicated that number of mortgage approvals for house purchases in the UK recorded an unexpected drop to 61.30 K, compared to market expectations of a rise to 62.50 K. It had recorded a revised level of 61.50 K in the prior month.

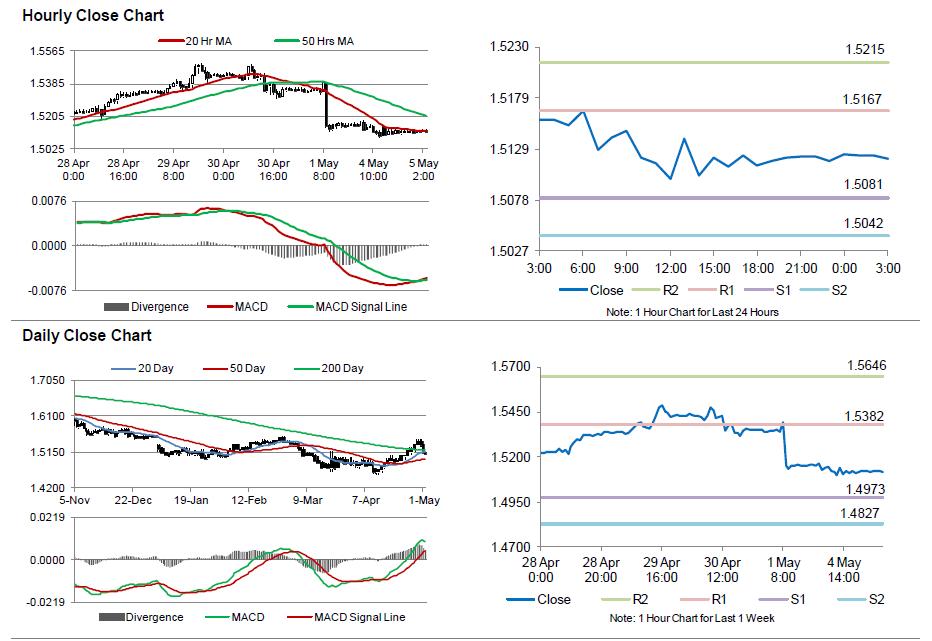

In the Asian session, at GMT0300, the pair is trading at 1.5119, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.5081, and a fall through could take it to the next support level of 1.5042. The pair is expected to find its first resistance at 1.5167, and a rise through could take it to the next resistance level of 1.5215.

Going forward, investors would closely monitor Britain’s construction PMI data, scheduled in a few hours for further direction.

The currency pair is trading/showing convergence with its 20 Hr and 50 Hr moving average.