For the 24 hours to 23:00 GMT, the GBP fell 0.48% against the USD and closed at 1.5609, after UK’s manufacturing PMI data disappointed in June.

UK’s manufacturing PMI unexpectedly fell to a level of 51.4 in June, its weakest reading in two years and compared to market expectations of a rise to 52.5. It followed a revised reading of 51.9 in May.

Separately, the BoE Governor, Mark Carney, warned that risks arising out of Greek crisis have posed significant amount of threat on Britain’s financial system, however he assured that the central bank was ready to take necessary action to maintain financial stability in the nation.

In the Asian session, at GMT0300, the pair is trading at 1.5614, with the GBP trading a tad higher from yesterday’s close.

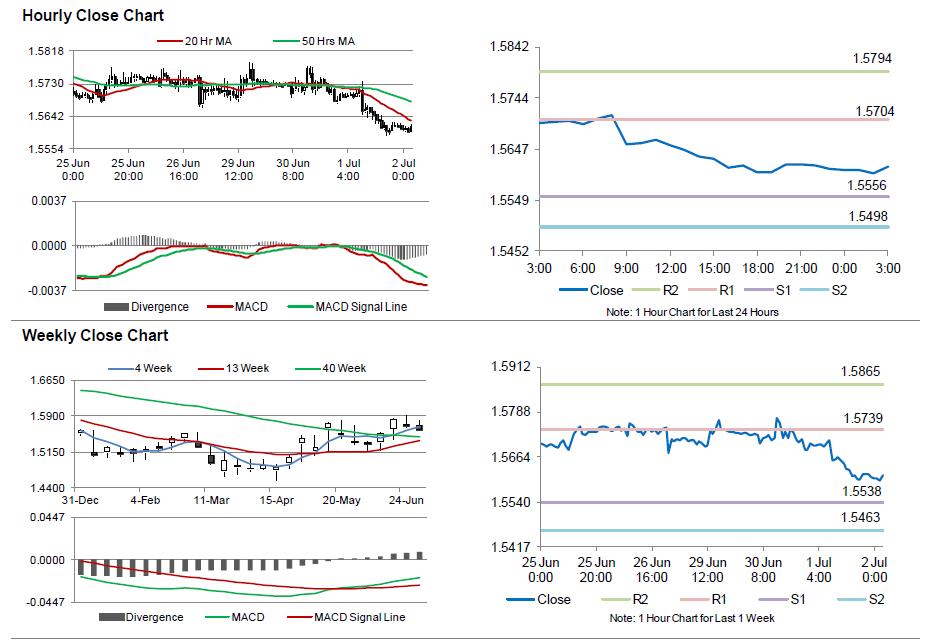

The pair is expected to find support at 1.5556, and a fall through could take it to the next support level of 1.5498. The pair is expected to find its first resistance at 1.5704, and a rise through could take it to the next resistance level of 1.5794.

Meanwhile, investors would keep a close eye on Britain’s construction activity data, set for release in a few hours to get better insights in the nation’s economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.