For the 24 hours to 23:00 GMT, the GBP fell 0.32% against the USD and closed at 1.5302, as manufacturing activity in the UK eased in August.

The UK manufacturing PMI unexpectedly dipped to a level of 51.5 in August, down from a level of 51.9 recorded in July, thus pointing towards weakness in the third quarter.

Other economic data revealed that UK mortgage approvals advanced more than anticipated to 68.80 K in July, its highest level since February 2014, compared to a revised reading of 67.07 K in June, thus showing that the nation’s housing market was regaining momentum. On the other hand, net consumer credit in the nation dropped to £1.173 billion in July, compared to prior month’s level of £1.230 billion.

In the Asian session, at GMT0300, the pair is trading at 1.5312, with the GBP trading 0.07% higher from yesterday’s close.

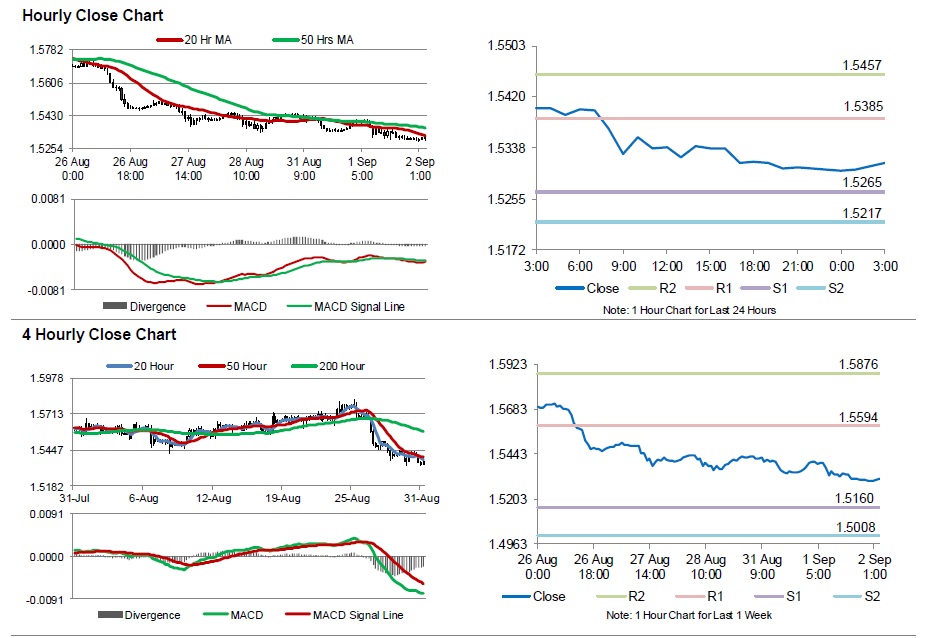

The pair is expected to find support at 1.5265, and a fall through could take it to the next support level of 1.5217. The pair is expected to find its first resistance at 1.5385, and a rise through could take it to the next resistance level of 1.5457.

Going forward, market participants would closely monitor Britain’s construction PMI data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.