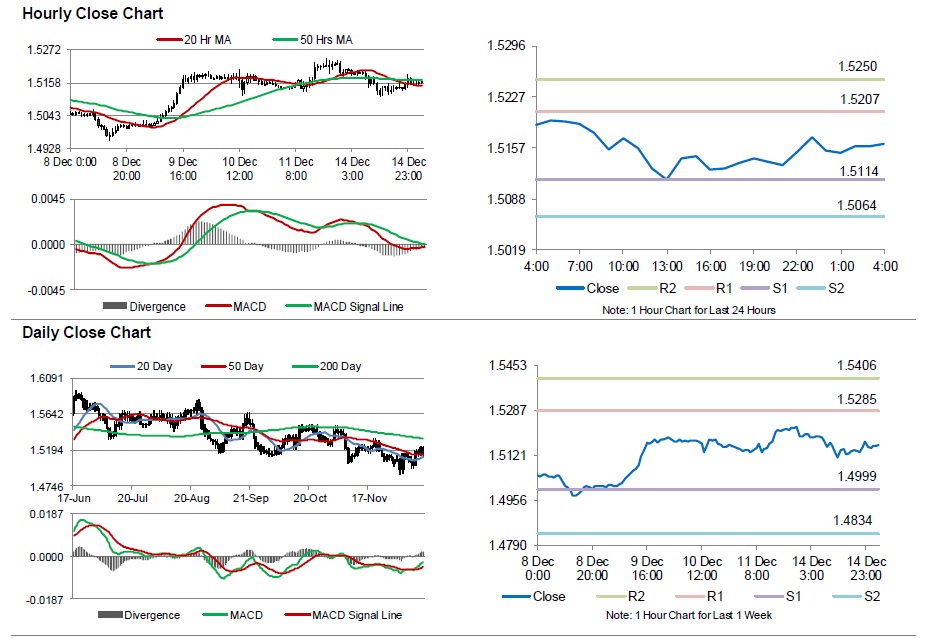

For the 24 hours to 23:00 GMT, the GBP fell 0.14% against the USD and closed at 1.5172.

Yesterday the BoE’s Deputy Governor, Minouche Shafik, stated that she will “tread carefully” when considering voting for an interest-rate increase. She further mentioned that the current rate of 0.5% was not the ultimate lower limit and stated that the central bank will not hesitate to push it down further, if needed.

In the Asian session, at GMT0400, the pair is trading at 1.5163, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.5114, and a fall through could take it to the next support level of 1.5064. The pair is expected to find its first resistance at 1.5207, and a rise through could take it to the next resistance level of 1.5250.

Moving ahead, market participants will concentrate on UK’s consumer price inflation data for November, scheduled to be released in a few hours to gauge the strength in the nation’s economy.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.